Income Tax Rates History Uk

Government bonds typically paid five percent.

Income tax rates history uk. Income threshold for high taxation rate on income was decreased to 32 011 in 2013. Then the internal revenue service adjusts the income brackets each year usually in late october or early november based on inflation. This page provides united kingdom personal income tax rate actual values historical data forecast chart statistics economic calendar and news. Download toprate historical xlsx 12 15 kb.

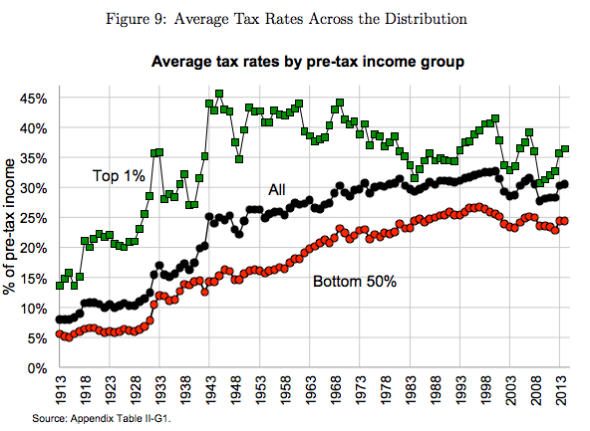

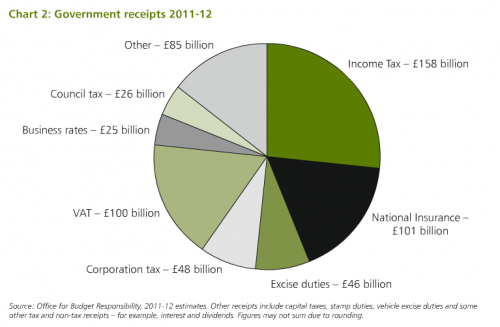

Altogether taxes provided at most 30 percent of national expenditures with the rest from borrowing. Here s a look at income tax rates and brackets over the years. In 1965 a separate corporation tax was established for businesses. From april 2010 the labour government introduced a 50 income tax rate for those earning more than 150 000.

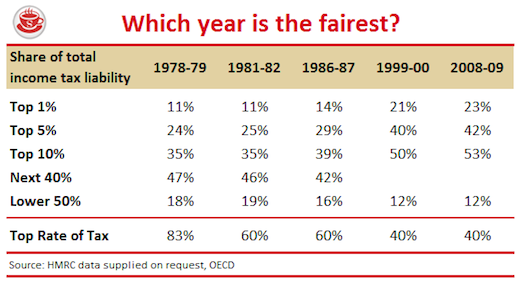

New tax bands and allowances are usually announced in the chancellor of the exchequer s budget. When margaret thatcher came to power in 1979 the income tax top rate was 83 whilst the basic rate was 33. Aside from the burden of running a blue water navy this was the era of the nightwatchman state. 2021 tax rates and income brackets use these.

There was only one rate of income tax and the highest it. The first records of taxation in england go right back to the 7 th century when there was a ruling by king ethelbhert of kent that all judicial fines should be paid to the crown. During the 1950s and 1960s income tax in the uk was at its highest levels reaching 90 at its highest rate. The income tax rate grew to 5s 25 in 1916 and 6s 30 in 1918.

In victorian britain it caught few people. The history of income tax. Download toprate historical pdf 8 91 kb. Congress sets the rates and a baseline income amount that falls into them when a tax law is created or changed.

This table reflects the removal of the 10 starting rate from april 2008 which also saw the 22 income tax rate drop to 20. Taxation in post war britain. Personal income tax rate in the united kingdom averaged 42 26 percent from 1990 until 2020 reaching an all time high of 50 percent in 2010 and a record low of 40 percent in 1991. 500 years later king john introduced an export tax on wool then in 1275 king edward i decided to put tax on wine and in the 16 th century a.

Historical and future rates you can view income tax rates and allowances for previous tax years.