Income Withholding Order Colorado

This form is the standard format prescribed by the secretary in accordance with usc 42 666 b 6 a ii.

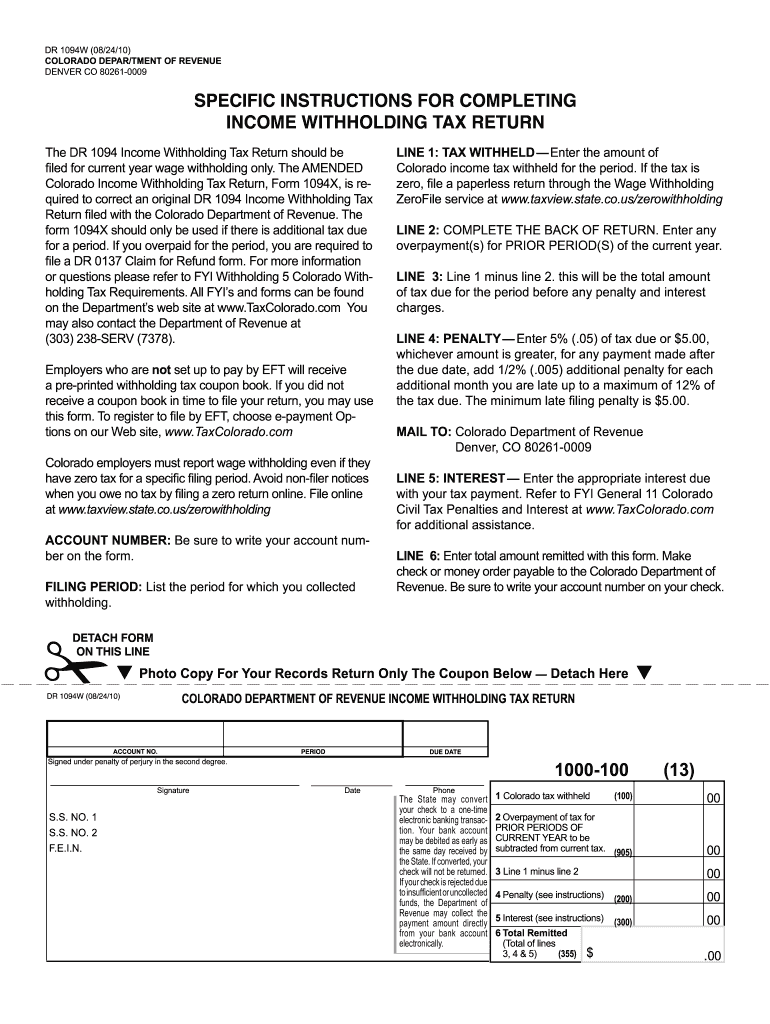

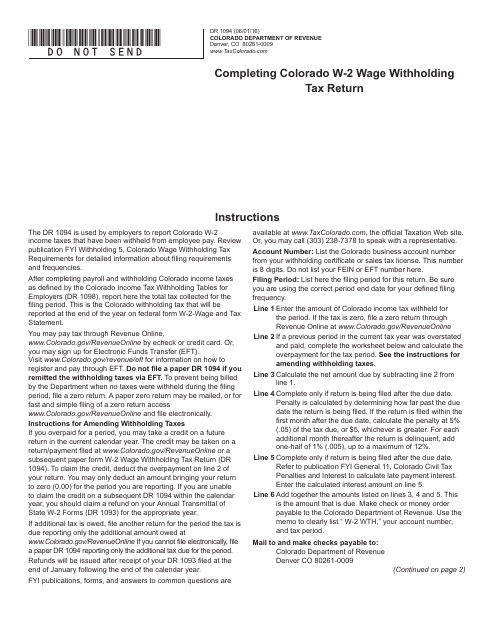

Income withholding order colorado. You must file a withholding tax return even if the tax paid is zero. Sales use tax. For any employee who has completed a 2020 irs form w 4 the employer must calculate the required colorado wage withholding using the 2020 income tax withholding worksheet dr1098 2020. If you cannot use revenue online.

Wage withholding cr 0100ap business application for wage withholding tax account dr 1093 annual transmittal of state w 2 forms dr 1094 colorado w 2 wage withholding tax return dr 1098 colorado income tax withh. Garnishments and income withholding orders. When a child support order is established the local county child support office will verify the paying parent s employment and may issue an income withholding order iwo. Income withholding for support iwo sample form colorado specific requirements please see c r s.

The aggregate colorado source income of all nonresident members included in the. Income withholding is the preferred method of child support collection. Forms in number order. This course only applies to colorado employers.

Employers w 2 filers use the colorado w 2 wage withholding tax return dr 1094 1099 issuers use the 1099 income withholding tax return dr 1107. This class has been updated to reflect changes to colorado garnishment law taking effect in october of 2020. Report tax evasion fraud. The iwo is the omb approved form used for income withholding in tribal intrastate and interstate cases as well as all child support orders that were initially issued in the state on or after january 1 1994 and all child support orders that were initially issued or modified in the state before january 1 1994 if arrearages occur.

14 14 111 5 for colorado specific requirements in regards to income. Excise fuel tax. Any employee who commences employment on or after january 1 2020 must complete the new 2020 irs form w 4. What is a valid garnishment.

What types of garnishments attach to employee wages in colorado. Tax policy research. Employers are required to file returns and remit tax on a quarterly monthly or weekly basis depending on the employer s total annual colorado wage withholding liability. Part ii of form 106 must be completed in order to file a composite return.

Tax education training. Colorado income tax withholding worksheet for employers dr 1098 prescribes the method for calculating the required amount of withholding.