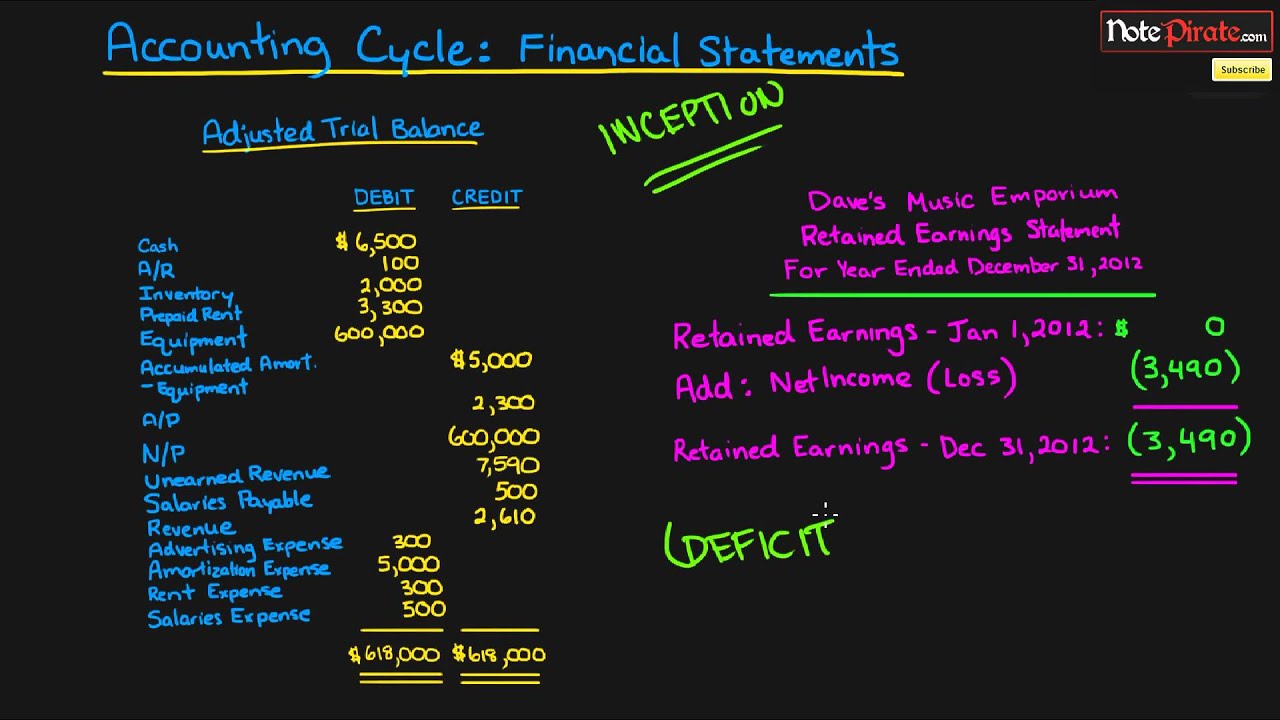

Net Income In The Income Statement Section Of The Worksheet Will Be Carried Over To The

This ending retained earnings balance is transferred to the balance sheet.

Net income in the income statement section of the worksheet will be carried over to the. Net income on the income statement section of the work sheet will a be carried over to the debit column of the balance sheet on the work sheet. Net income or loss from business consists of three sections. Ending capital is carried from the statement of owners equity to the balance sheet. C remain on the income statement section of the work sheet.

Be carried over to the credit column of the balance sheet on the work sheet. The amount of net income calculated on an income statement is correct if. B be carried over to the credit column of the balance sheet on the work sheet. Net income on the income statement section of the work sheet will be carried over to the debit column of the balance sheet on the work sheet.

None of these choices are correct. A it is the same as the net income shown on the work sheet b debits equal credits c it is the same as the net income shown on the balance sheet d none of these. Remain on the income statement section of the work sheet. D none of these choices.

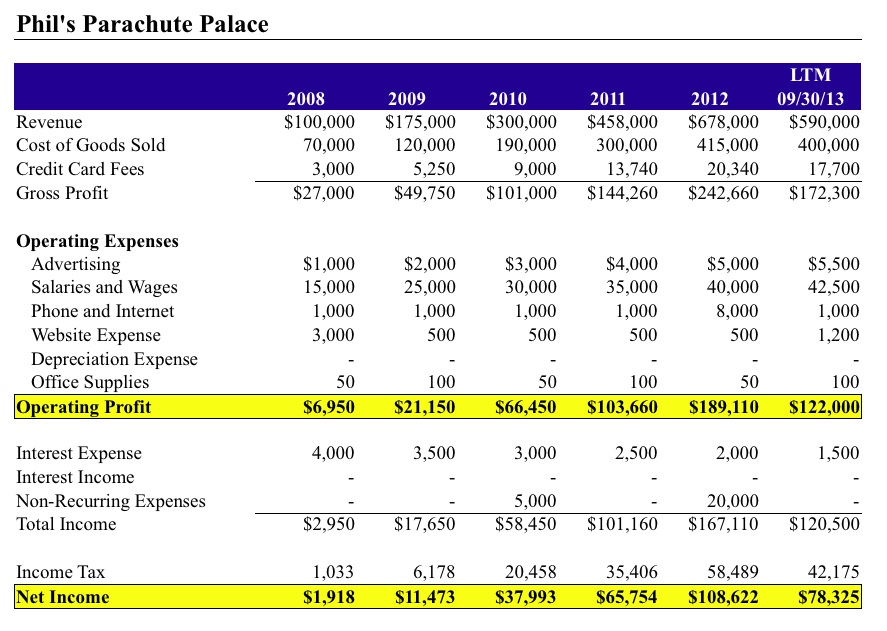

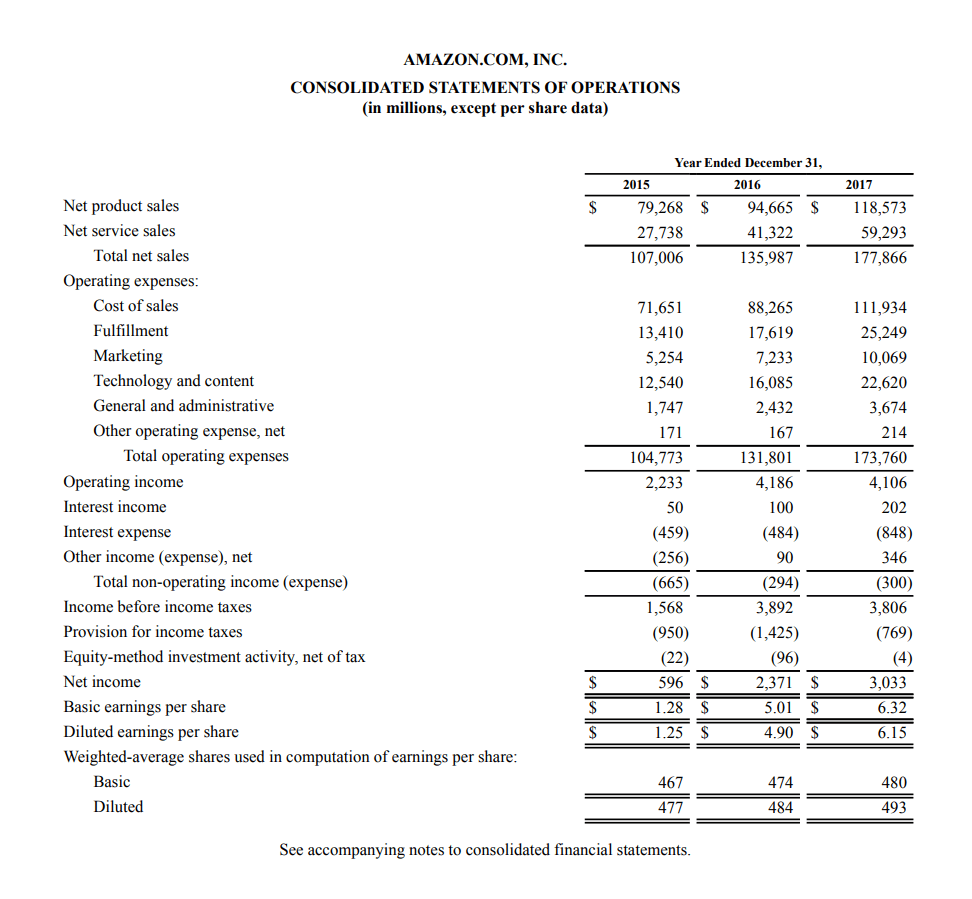

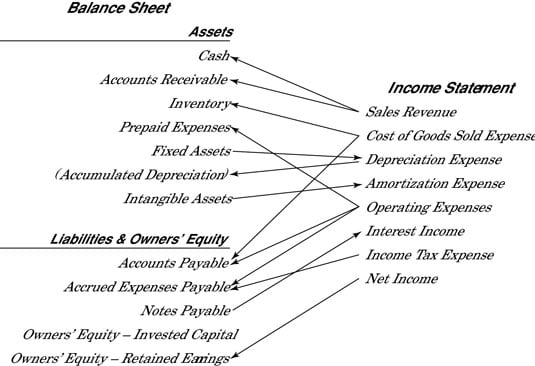

Revenues less expenses ordered largest to smallest amount with miscellaneous expense listed last. Net income is carried from the income statement to the balance sheet. Payg payment summary business and personal services income. Adjusted trial balance credit column.

Balance sheet credit column. Net income in the income statement section of the work sheet will be carried over to the. Be carried over to the credit column of the balance worksheet. Identify which of the following steps are used to prepare the income statement section of the worksheet all that apply.

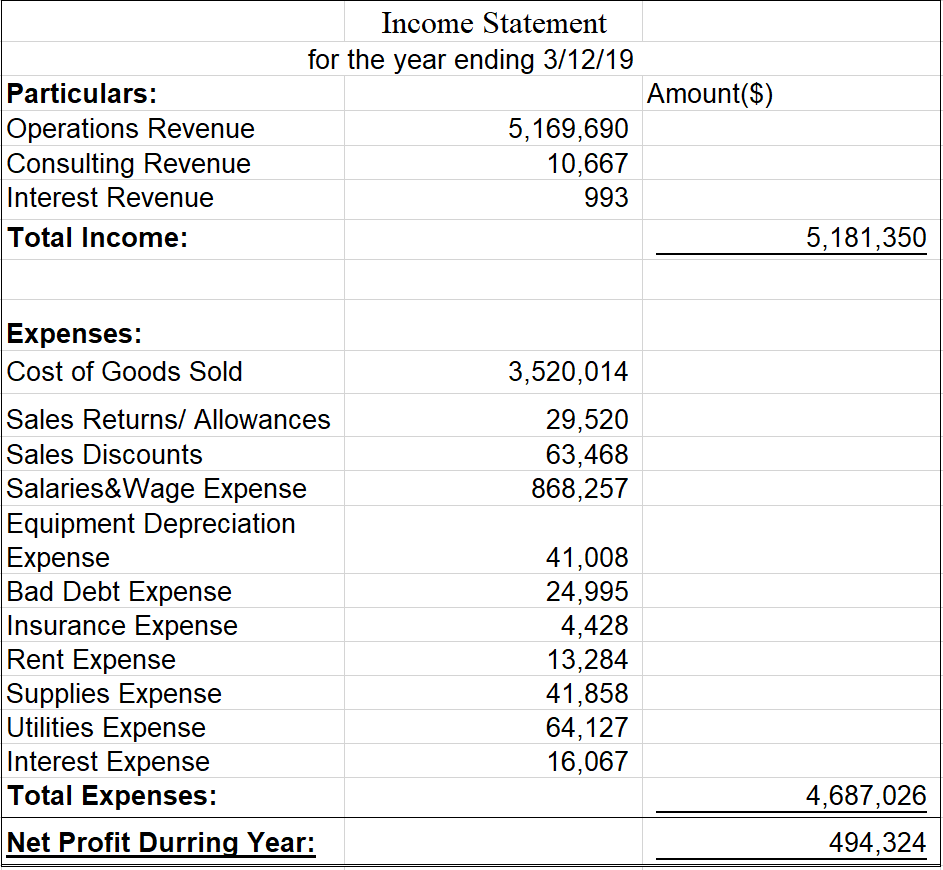

The income statement also called the profit and loss statement is a report that shows the income expenses and resulting profits or losses of a company during a specific time period the income statement is the first financial statement typically prepared during the accounting cycle because the net income or loss must be calculated and carried over to the. The income statement will present. Cash short or over 8 sales 708 b cash 700 sales 700 c. Dividends are taken away from the sum of beginning retained earnings and net income to get the ending retained earnings balance of 4 565 for january.

None of these choices. Complete this worksheet before proceeding. Notice the net income of 4 665 from the income statement is carried over to the statement of retained earnings. Previous question next question.

You will need the primary production worksheet if you are a primary producer to determine some of the amounts in this section. What is an income statement. Net income in the income statement section of the work sheet will be carried over to the. Balance sheet debit column.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)