Oregon Income Tax Rate 2020

6 950 per year in 2020.

Oregon income tax rate 2020. Oregon state income tax rate table for the 2019 2020 filing season has four income tax brackets with or tax rates of 5 7 9 and 9 9 for single married filing jointly married filing separately and head of household statuses. Oregon department of revenue programs individuals personal income tax rates and tables personal income tax rates and tables menu oregon gov. For payroll periods of less than a year figure the annual withholding divided by the number of pay periods see page 5 or 6. This page has the latest oregon brackets and tax rates plus a oregon income tax calculator.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Single or married filing separately if your taxable income is. Income tax tables and other tax information is sourced from the oregon department of revenue. Oregon s income tax brackets were last changed two years ago for tax year 2018 and the tax rates were previously changed in 2010.

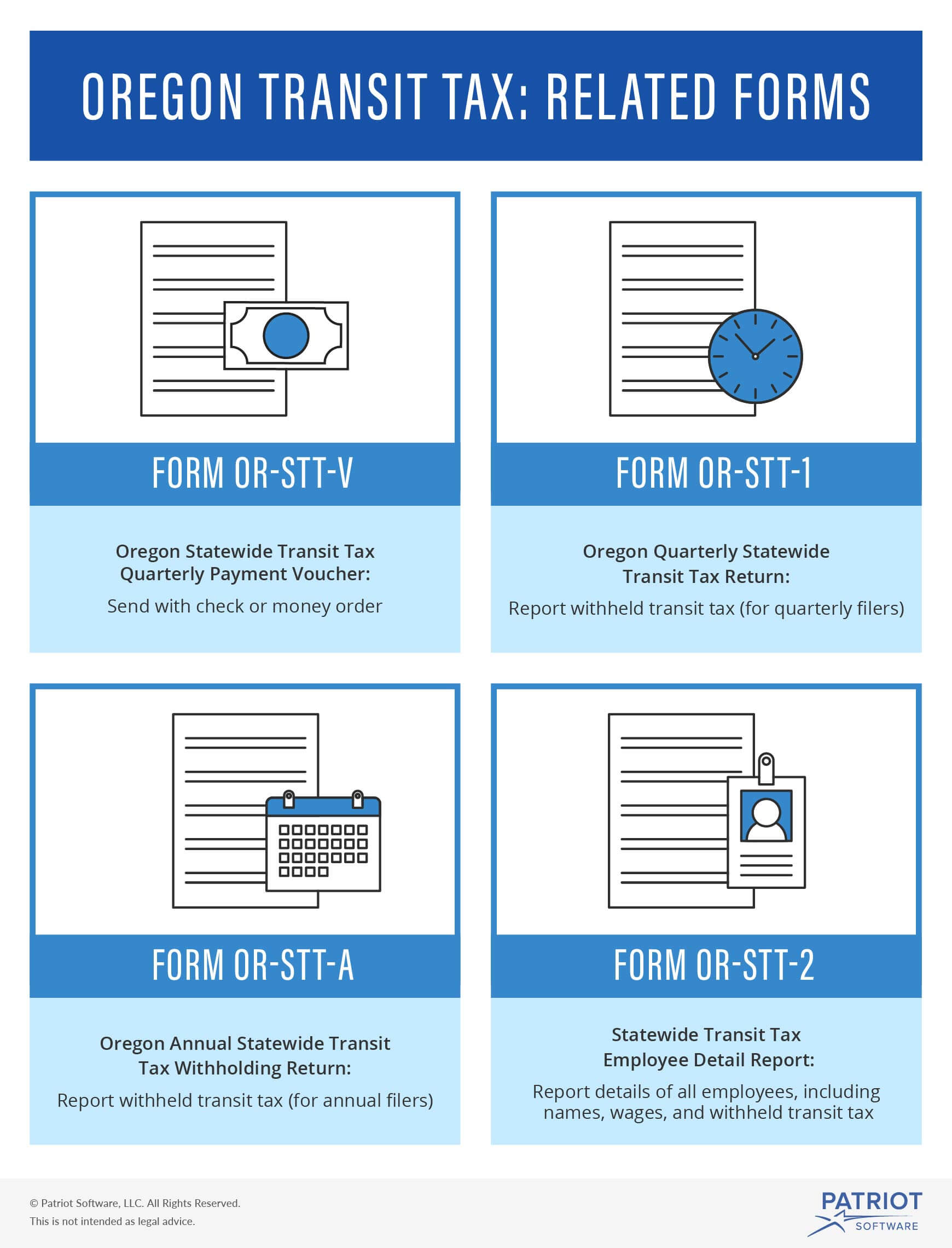

The oregon tax calculator is designed to provide a simple illlustration of the state income tax due in oregon to view a comprehensive tax illustration which includes federal tax medicare state tax standard itemised deductions and more please use the main 2020 21 tax reform calculator. Tax rate used in calculating oregon state tax for year 2020 on july 1 2018 oregon employers must start withholding the transit tax one tenth of 1 percent or 001 from. Married filing jointly or qualifying widow er. The oregon income tax has four tax brackets with a maximum marginal income tax of 9 90 as of 2020.

Wages of oregon residents regardless of where the work is performed. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in april 2020. Detailed oregon state income tax rates and brackets are available on this page. 2020 oregon tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator.

That s because oregon personal income tax law limits the amount of federal income tax that is subtracted from federal adjusted gross income agi. Oregon income tax rate 2019 2020. Tax worksheet to find their estimated 2020 tax required annual single or married filing separately.