The Income Statement Approach For Estimating Bad Debts Uses A Percentage Of

The income statement approach for estimating bad debts uses a percentage of the amount recorded for bad debt expense does not depend on the balance of the allowance for uncollectible accounts.

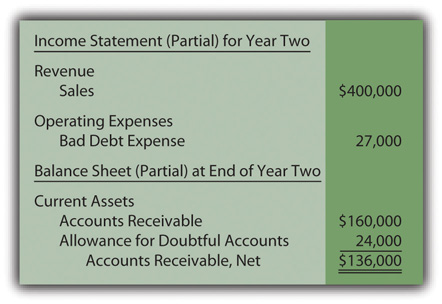

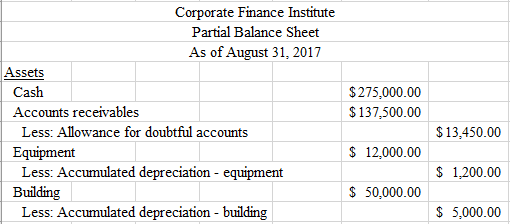

The income statement approach for estimating bad debts uses a percentage of. The income statement approach for estimating bad debts uses a percentage of. The balance sheet approach to estimating future bad debts indirectly determines bad debt expense by estimating the net realizable value for accounts receivable that exist at the end of the period. The balance sheet approach to bad debts expresses uncollectible accounts as a percentage of accounts receivable. Percentage of sales method is an income statement approach for estimating bad debts expense.

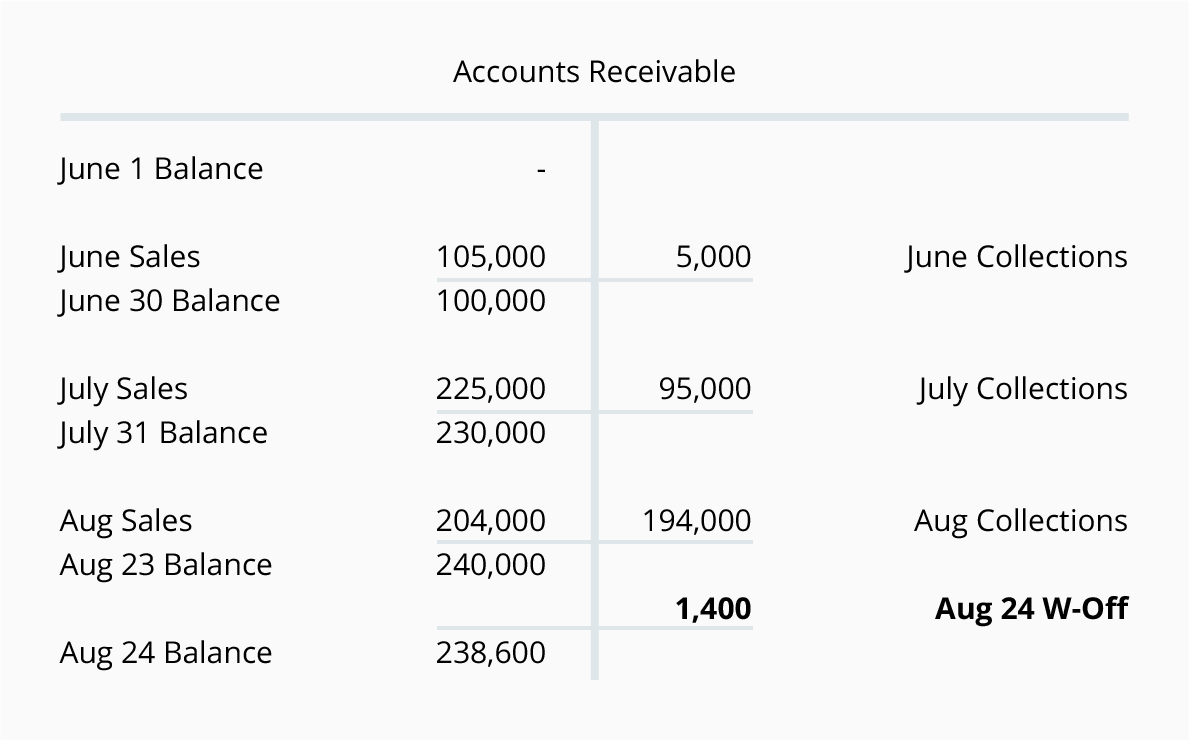

In applying the percentage of sales method companies annually review the percentage of uncollectible accounts that resulted from the previous year s sales. On february 28 the firm had accounts receivable in the amount of 555 000 and allowance for doubtful accounts had a credit balance of 370 before adjustment. The income statement approach for estimating bad debts uses a percentage of net credit sales sales to customers in which the customers pay within 30 to 60 days are referred to as credit sales or sales on account a is. Which of the following statements is true with respect to the percentage of credit sales method for estimating uncollectible accounts.

Under this method bad debts expense is calculated as percentage of credit sales of the period. To account for this lost income businesses record bad debt expense on a periodic basis. Let s look at an example. It s an inevitable reality that not all customers will pay down their account balances.

The income statement approach to estimating bad debts determines bad debt expense directly by relating to uncollectible accounts credit sales the balance sheet approach to estimating future bad debts indirectly determines bad debt expense by estimating the for accounts receivable that exist at the end of the period. The difference between. Collection period the ratio that shows the approximate number of days the average accounts receivable balance is outstanding is referred to as the average. Which is why it is also called an income statement approach.

Assume that company abc uses past experience to estimate that 3 of all credit sales result in uncollectible amounts i e bad debt expense. The percentage of receivables approach to estimating bad debts expense is used by hayes company. The credit manager estimated that uncollectible accounts would amount to 5 of. On the income statement bad debt expense would still be 1 of total net sales or 5 000.

The percentage to be.