Vermont Income Tax Brackets 2020

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

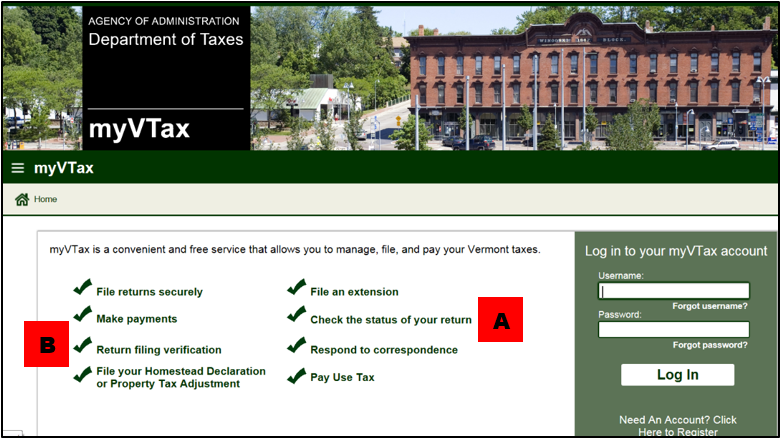

Vermont income tax brackets 2020. Commissioner craig bolio 802 828 2505 department directory taxpayer services 802 828 2865 mon tue thu fri 7 45 am 4 30 pm taxpayer assistance window. 2020 income tax withholding instructions this document is designed to provide you with an overview of the vermont withholding tax. 2019 vt rate schedules. 2018 vt rate schedules.

Vermont state income tax rate table for the 2019 2020 filing season has four income tax brackets with vt tax rates of 3 35 6 6 7 6 and 8 75 for single married filing jointly married filing separately and head of household statuses. The vermont income tax has four tax brackets with a maximum marginal income tax of 8 75 as of 2020. Vermont income tax rate 2019 2020. 2019 vt tax tables.

The top vermont tax rate decreased last year from 8 95 to the current 8 75. Vermont s income tax brackets were last changed two years ago for tax year 2018 and the tax rates were previously changed in. There are 125 days left until taxes are due. 2020 vermont tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator.

If you need further clarification contact information for the business section of the vermont department of taxes is found on page 2 of this document or by visiting our website at tax vermont gov. Income tax tables and other tax information is sourced from the vermont department of taxes. Commissioner craig bolio 802 828 2505 department directory taxpayer services 802 828 2865 mon tue thu fri 7 45 am 4 30 pm taxpayer assistance window. 2020 income tax withholding instructions tables and charts.

This page has the latest vermont brackets and tax rates plus a vermont income tax calculator. Detailed vermont state income tax rates and brackets are available on this page. Start filing your tax return now.

:max_bytes(150000):strip_icc()/Clipboard01-42e418fa494247adb22cf86e98cd3537.jpg)