Equity Method Accounting Income Statement Example

Equity method example suppose a business the investor buys 25 of the common stock of another business the investee for 220 000 in cash.

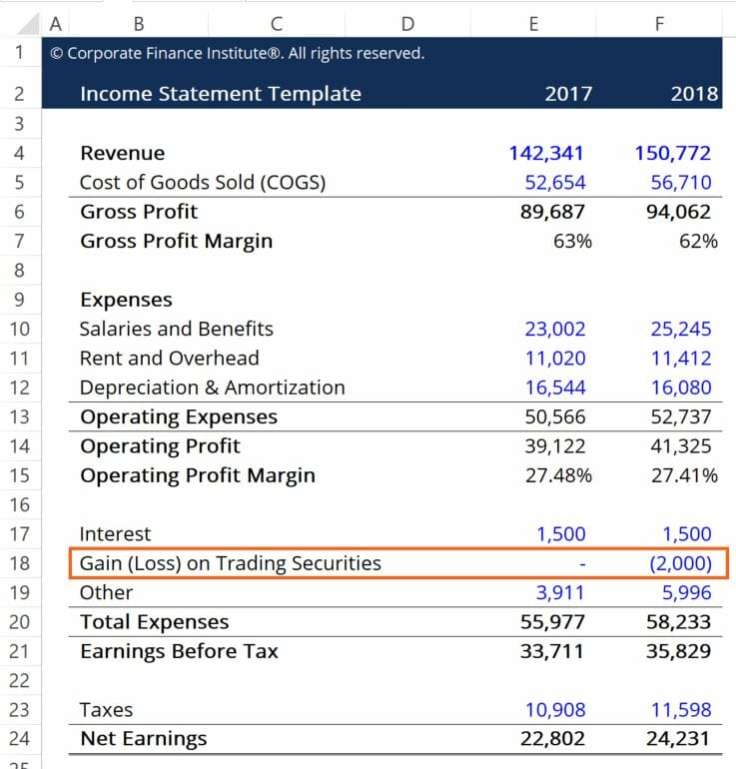

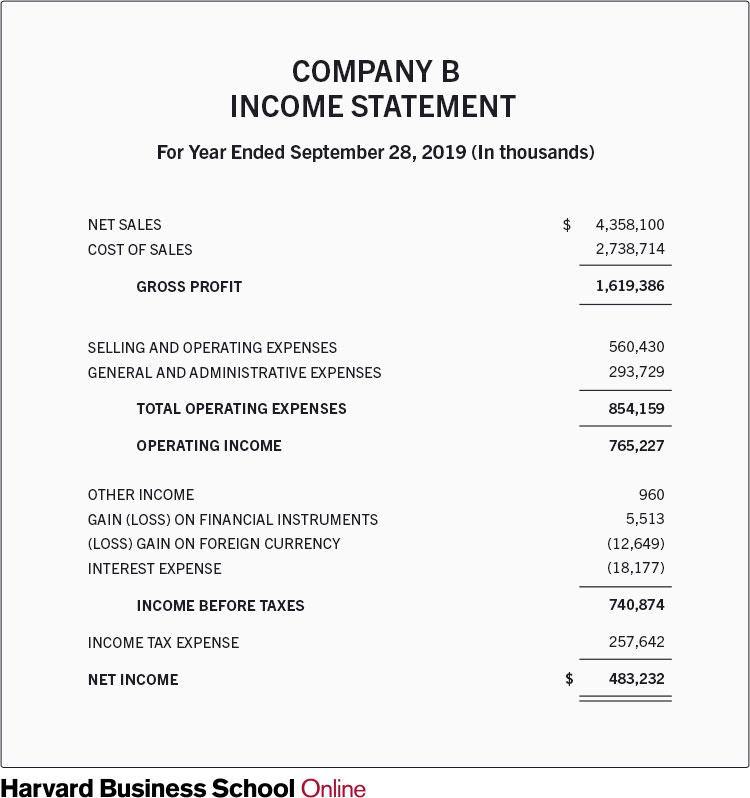

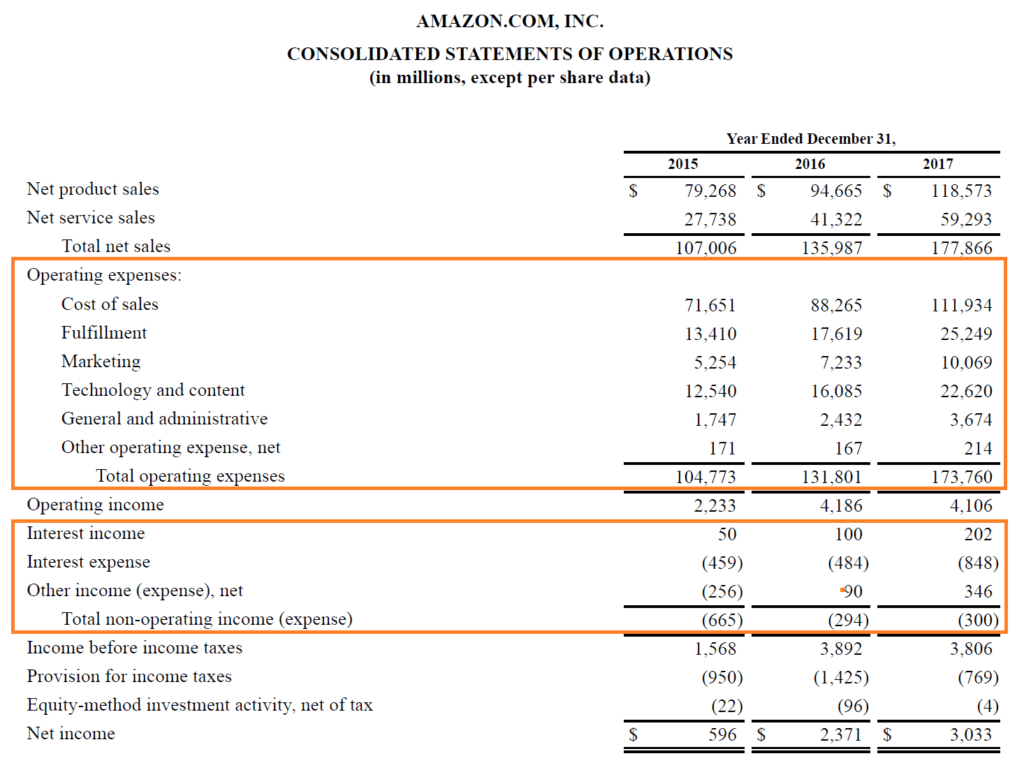

Equity method accounting income statement example. Equity accounting example we will use an example to explain how the investment should be recorded on the statement of the financial position and the statement of financial performance. For example if saks earned 100 million and macy s owned 30 it would include a line on the income statement for 30 million in income 30 of 100 million even if these earnings were never paid out as dividends. Company b generated profits of 500 000 during the year. This differs from the consolidation method where the investor exerts full control.

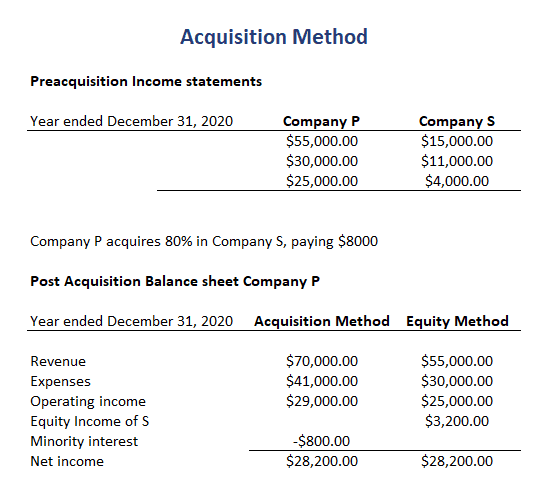

Simple illustration of application of equity method. The equity method is a type of accounting used in investments. Entity b s net assets as per its financial statements amounted to 150. Entity a acquired 25 interest in entity b on 1 january 20x1 for a total consideration of 50m and accounts for it using the equity method.

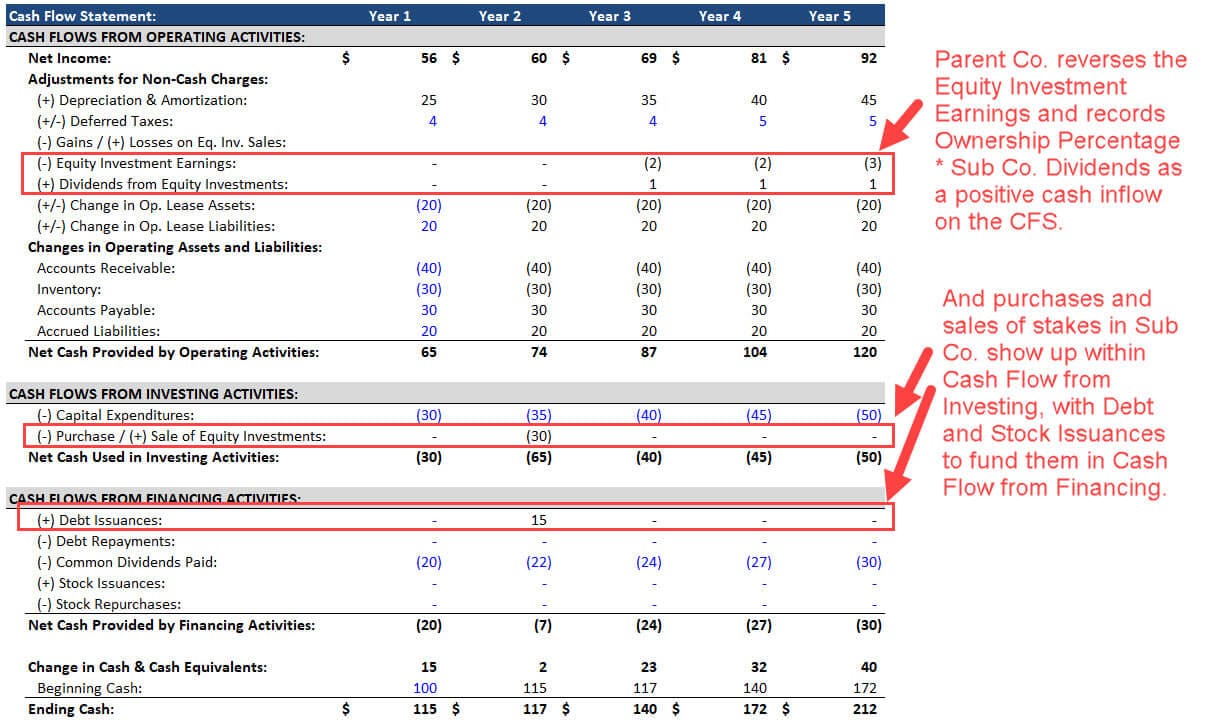

Under the equity method tone makes the following entry as of the end of year. The 15 000 income from dutch would be reported on tone s income statement. Because total outstanding stocks are 4 92 billion your holding is 20 32 1b 4 92b equity method must be applied. Let s assume that company a bought 40 of company b in the beginning of the year for 500 000.

This method is used when the investor holds significant influence over investee but not full control over it as in the relationship between parent and subsidiary. For example assume that tone company the investor owns 30 of dutch company the investee and dutch reports 50 000 net income in the current year. The investor is deemed to exert significant influence over the investee and therefore accounts for its investment using the equity method of accounting. In most cases macy s would include a single entry line on its income statement reporting its share of saks earnings.

Example of the equity method for example assume abc company purchases 25 of xyz corp for 200 000. At the end of year 1 xyz corp reports a net income of 50 000 and pays 10 000 in dividends to. Let s say you purchased 1 billion shares of apple instead of 1 million at 144 02 per share. The following quarter company b reports net income of 200 and announces a 40 dividend.

Equity method accounting under the equity method the investor begins as a baseline with the cost of its original investment in the investee and then in subsequent periods recognizes its share of the profits or losses of the investee both as adjustments to its original investment as noted on its balance sheet and also in the investor s income statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-02-23bef448b8aa4c9bac46c8e15b2b9f0a.jpg)