Federal Income Tax Withholding Tables 2021

The tax year 2021 maximum earned income credit amount is 6 728 for qualifying taxpayers who have three or more qualifying children up from a total of 6 660 for tax year 2020.

Federal income tax withholding tables 2021. If you have an automated payroll system use the worksheet below and the percentage method tables that follow to figure federal income tax withholding. This is published with the irs publication 15 t. Employers must use the federal tax withholding tables along with the employee s forms w 4 to figure out the income tax withholding. For this employers need to use the federal withholding tables and 2021 or previously filed form w4 by the employee.

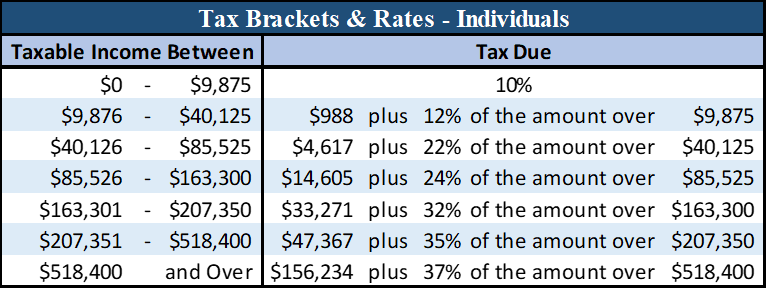

2018 federal income tax brackets. How to calculate federal tax based on your annual income. Percentage method tables for automated payroll systems. Tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator.

The bottom rate is 10 while the top rate has fallen from 39 6 to 37 from 2017 federal income tax bracket system. Since withholding tax is mandatory all employers must withhold tax according to the employee s anticipated tax return and other information guided by the internal revenue service. Employers will then use the information provided on the employee s form w 4 along with the federal withholding tables to figure out how much federal income tax needs to be withheld. This method works for forms w 4 from 2019 or earlier and forms w 4 from 2020 or later.

The federal estate tax exemption for decedents dying will increase to 11 7 million per person or 23 4 million per married couple in 2021. Employers must use the federal tax withholding tables with the employee s w 4. From 2020 and beyond the irs will not publish federal withholding tables publication 15. This method also works for any amount of wages.

For unmarried individuals the prices will get expired in 2025 unless congress decides on extending it. The revenue procedure contains a table providing maximum earned income credit amount for other categories income thresholds and phase outs. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Gift tax exclusion foreign gifts.

The 2018 federal income tax brackets also houses the same seven different taxation rates. The 2021 tax calculator uses the 2021 federal tax tables and 2021 federal tax tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. The federal withholding tables feature a variety of tax withholding methods. This is done for every employee.

The irs publication 15 consists of the tax withholding tables.

:max_bytes(150000):strip_icc()/Clipboard01-42e418fa494247adb22cf86e98cd3537.jpg)