How To Read Income Tax Return Statement

Identifies the business the financial statement title and the time period summarized by the statement.

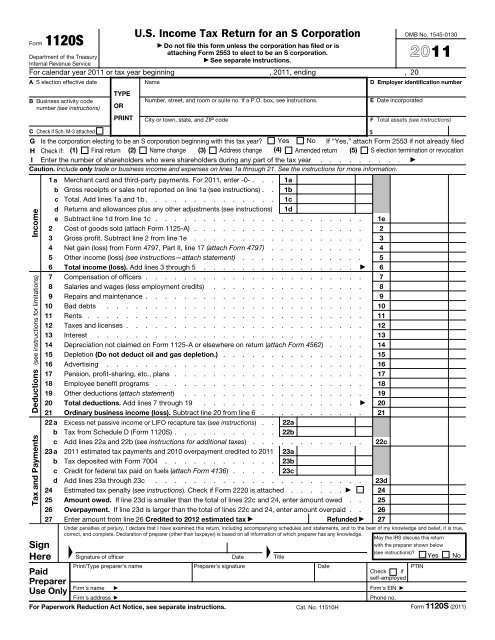

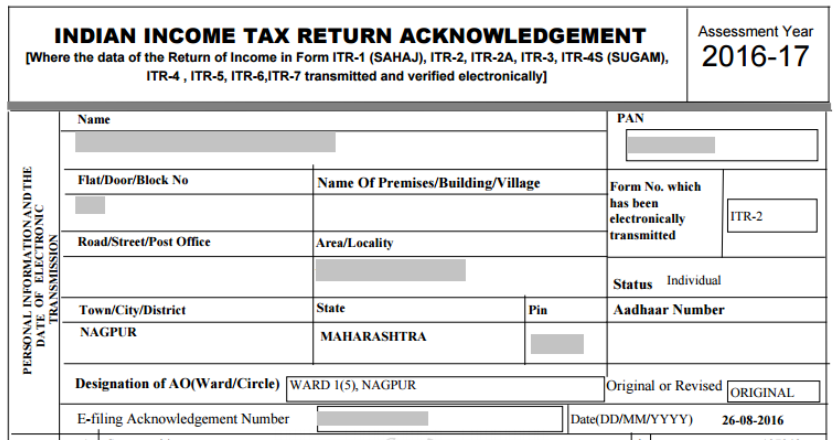

How to read income tax return statement. However with a bit of thought and patience reading understanding and completing a tax return doesn t have to be an ulcer inducing experience. The basic suite of financial statements a company produces at least annually consists of the statement of cash flows the balance sheet or statement of financial position and the income statement. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. Sometimes the form seems to have been written in a foreign language and the instructions can be even worse.

Add lines 7 21 and you ll find your total income on line 22. How to read a tax return transcript. Knowing which form to use there are three forms. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail.

Each step down the ladder in an income statement involves the deduction of an expense. Add this to the income statement below the pre tax income figure. Next we have any subtractions from your income on lines 23 35. Enter the figure into the final line item of your income.

This example financial report is designed for you to read from the top line sales revenue and proceed down to the bottom line net income. To determine your business s net income subtract the income tax from the pre tax income figure. How to read japanese tax statement gensen choshu hyo taxpayer s address recipient number individual number hidden job title taxpayer s name total salary earned during the year gross salary income after employment income deduction total amount of deductions from income amount of withholding tax. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts.

The second is that an income statement is based on a few very simple concepts which you already understand. If you re an employee one of those forms is the form w 2 wage and tax statement no matter. Simply provide the irs with basic identification information such as your name and social security. Depending on your income level up to 85 of your social security income can be taxed yes another tax on a tax.

To calculate income tax multiply your applicable state tax rate by your pre tax income figure. When you finally sit down to do your taxes reading the tax return form could be a challenge. If you need tax return information you can get a tax return transcript from the irs at no charge.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)