Income Statement Largest Expense

The income statement summarizes a company s revenues and expenses over a period either quarterly or annually.

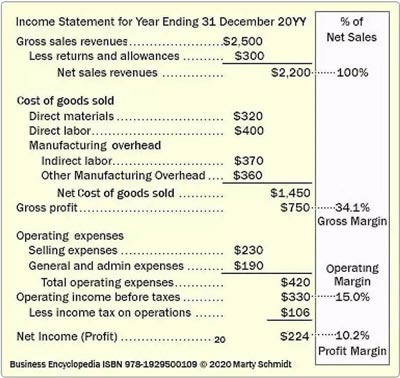

Income statement largest expense. Accrual accounting requires that expenses be with revenues. Cost of goods sold. Examples guide it becomes necessary to get into the habit of projecting income statement line items. The largest expense on a retailer s income statement is usually its of goods sold.

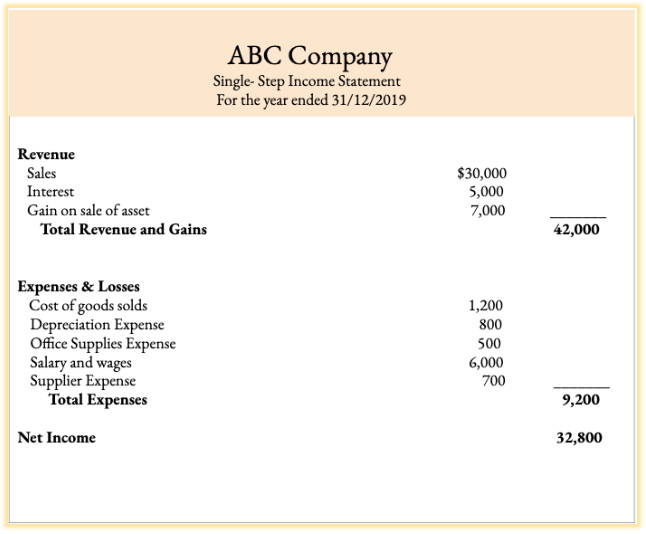

Cost of goods sold 2 using a perpetual inventory system which of the following entries would record the cost of merchandise sold on credit. The income statement comes in two forms multi step and single step. Income statement and balance sheet differences. When building a three statement model 3 statement model a 3 statement model links the income statement balance sheet and cash flow statement into one dynamically connected financial model.

The largest expense category on the income statement of most merchandising companies is a. None of the above. There are several categories of operating expenses the biggest of which is known as selling general and. And amortization are non cash non cash expenses non cash expenses appear on an income statement because accounting principles require them to be recorded despite not actually being paid for with cash.

Debit inventory and credit cost of goods. The income statement is also known as the statement of. Depreciation expense is used to better reflect the expense and value of a long term asset as it relates to the revenue it generates. Income statement is one of the financial statements of the company which provides the summary of all the revenues and the expenses over the time period in order to ascertain the profit or loss of the company whereas balance sheet is one of the financial statements of the company which presents the shareholders equity liabilities and the.

The general rule of thumb. Projecting income statement line items.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-02-23bef448b8aa4c9bac46c8e15b2b9f0a.jpg)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)