Maximum Income While Receiving Social Security Benefits

Your benefits may increase when you work.

Maximum income while receiving social security benefits. Any type of free rent shelter or food benefits you are receiving from a non governmental source. Even if you file taxes jointly social security does not count both spouses incomes against one spouse s earnings limit it s only interested in how much you make from work while receiving benefits. Payments you receive from sources such as social security veterans benefits a pension alimony or child support. Millions of americans receiving social security benefits also have income from work whether it s staying in their full time career or taking on part time jobs in their spare time.

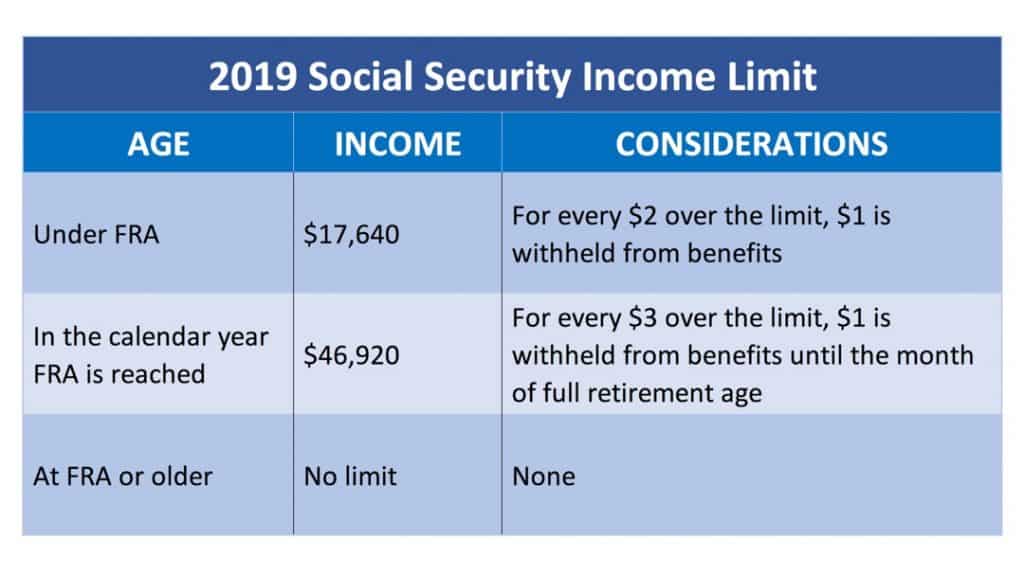

This is called unearned income because you don t do anything to get it each month. Social security s annual earnings limit the maximum people who claim social security early can make from work without triggering a benefit reduction no longer applies as of the month you attain full retirement age which is. Your social security benefits would be reduced by 5 000 1 for every 2 you earned over the limit. You would receive 4 600 of your 9 600 in benefits for the year.

If your countable income is over the allowable limit you cannot receive ssi benefits. If you will reach full retirement age during that same year it will be reduced every month until you reach full. If you receive social security benefits and are under your full retirement age for the entire year for people born between 1943 and 1954 that age is 66 your benefits will be lowered if the amount you earn from a job exceeds the social security administration s annual limit. 9 600 5 000 4 600 reach full retirement age in august 2020.

As long as you continue to work even if you are receiving benefits you will continue to pay social security taxes on your earnings. En español no. For 2010 the limit is 14 160. 28 240 total wages the social security income limit of 18 240 10 000 income in excess of limit because this is a full calendar year during which rosie is receiving benefits but is not yet full retirement age the benefits reduction amount is 1 reduction for every 2 in excess wages.

Total monthly income 300 social security benefit 1 300 social security benefit 20 not counted 280 countable income. Some of your income may not count as income for the ssi program. You work and earn 28 240 10 000 over the 18 240 limit during the year. En español at that age you can earn any amount and collect the full social security retirement spousal or survivor benefit you are entitled to receive.

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-42e418fa494247adb22cf86e98cd3537.jpg)