Ohio Income Tax Voucher

Go to tax ohio gov for more information.

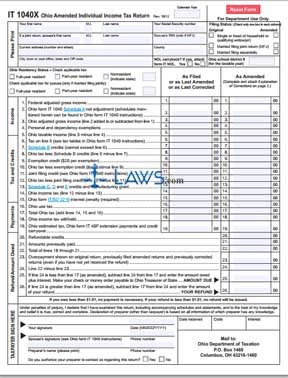

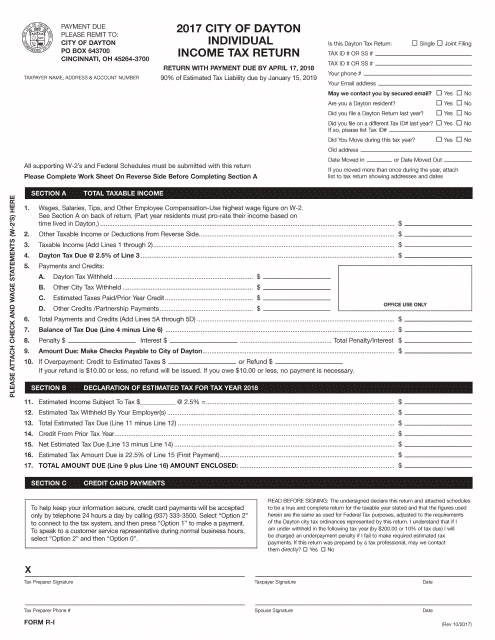

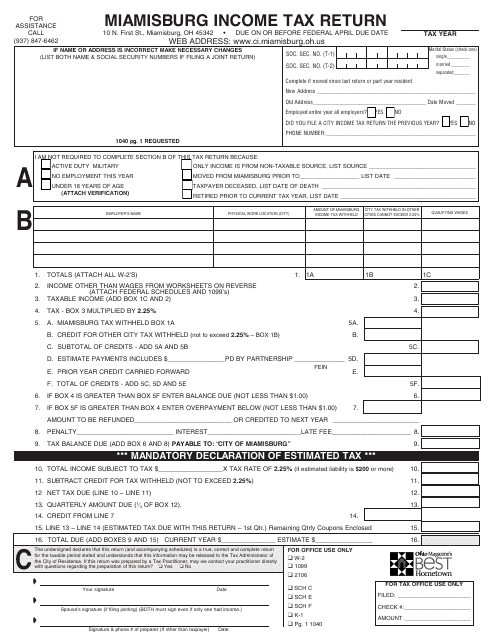

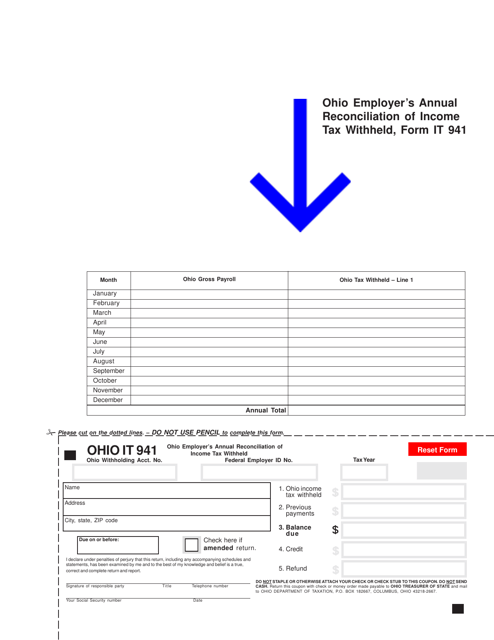

Ohio income tax voucher. Printable ohio income tax form it 1040es. If you estimate that you will owe more than 500 in tax for 2020 after subtracting your estimated withholding and credits then you should make. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Joint filers should determine their combined estimated ohio tax liability and make joint estimated payments.

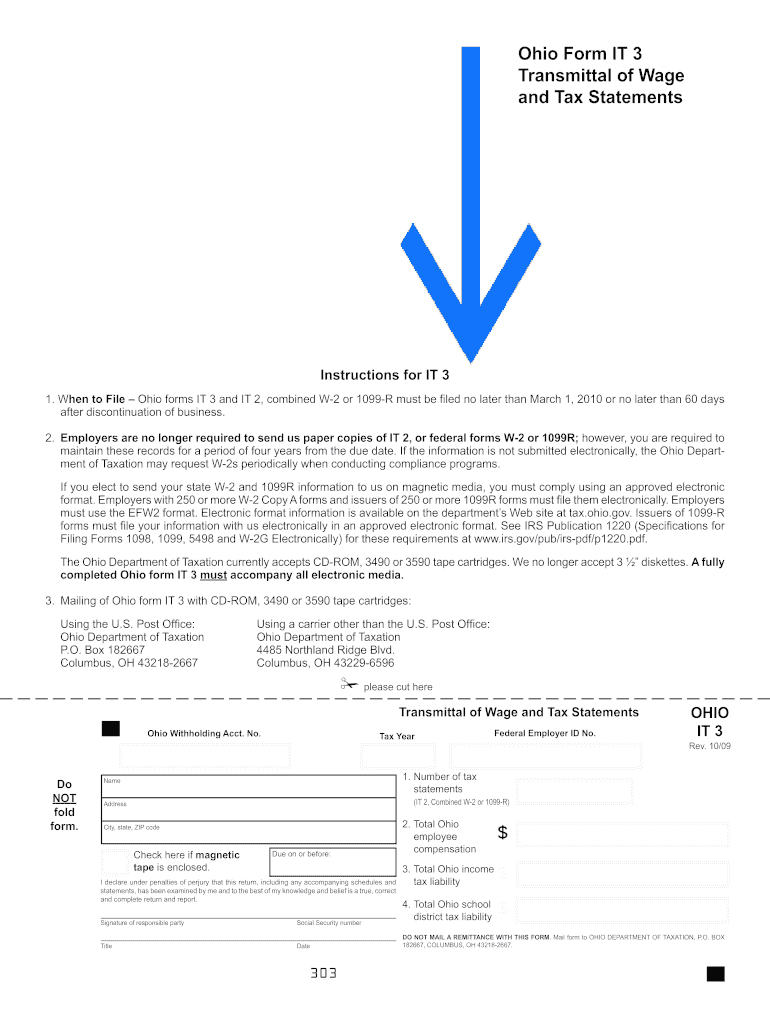

See information release it 2006 01 entitled estimated payment allocation process available at tax ohio. Joint filers should determine their combined estimated ohio tax liability and make joint estimated payments. This form is for income earned in tax year 2019 with tax returns due in april 2020 we will update this page with a new version of the form for 2021 as soon as it is made available by the ohio government. Use the ohio it 1040es vouchers to make estimated ohio income tax payments.

Joint filers should determine their combined estimated ohio tax liability and make joint estimated payments. Use the ohio it 1040es vouchers to make estimated ohio income tax payments. We last updated ohio form it 40p in january 2020 from the ohio department of taxation. Most popular newest at tax ohio gov use the ohio it 1040es vouchers to make estimated ohio income tax payments.

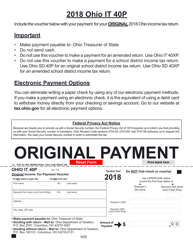

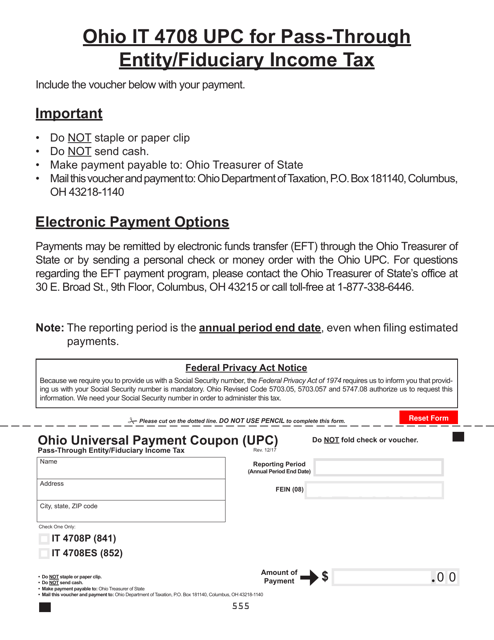

See information release it 2006 01 entitled estimated payment allocation process available at tax ohio gov. Do not send cash. Ohio treasurer of state payment mail this voucher and payment to. Ohio department of taxation p o.

Electronic payment options you can make your payment electronically even if you file by paper. Pay by elec tronic check credit card or debit card via the department s online services. Ohio governor mike dewine recently signed two bills house bills 62 and 155 that enact several significant ohio income tax changes for the upcoming tax filing season. 2019 income tax changes.

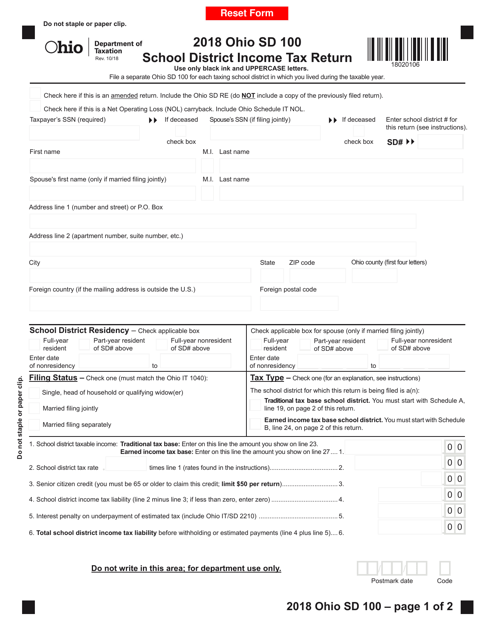

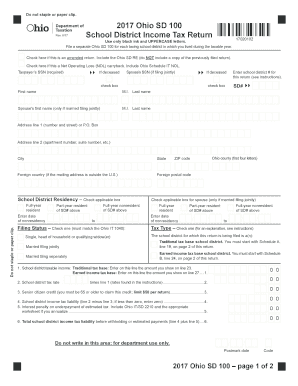

Use the ohio sd 100es vouchers to make estimated ohio school district tax payments. Important make payment payable to. The ohio department of health offers online information updated daily or call them at 1 833 4askodh. 2020 ohio it 1040es voucher 1 due july.

Amount of make payment payable to. Do not use this voucher to make an estimated payment for ohio income tax. Ohio treasurer of state include the tax year and the last four digits of your ssn on the memo line of your payment. Estimated tax payments must be sent to the ohio department of revenue on a quarterly basis.

Income tax payment voucher form it 40p 2019 ohio it 40p include the voucher below with your payment for your original 2019 ohio income tax return. Joint filers should determine their combined estimated ohio tax liability and make joint estimated payments. See information release it 2006 01 entitled estimated payment allocation process available at tax ohio gov.