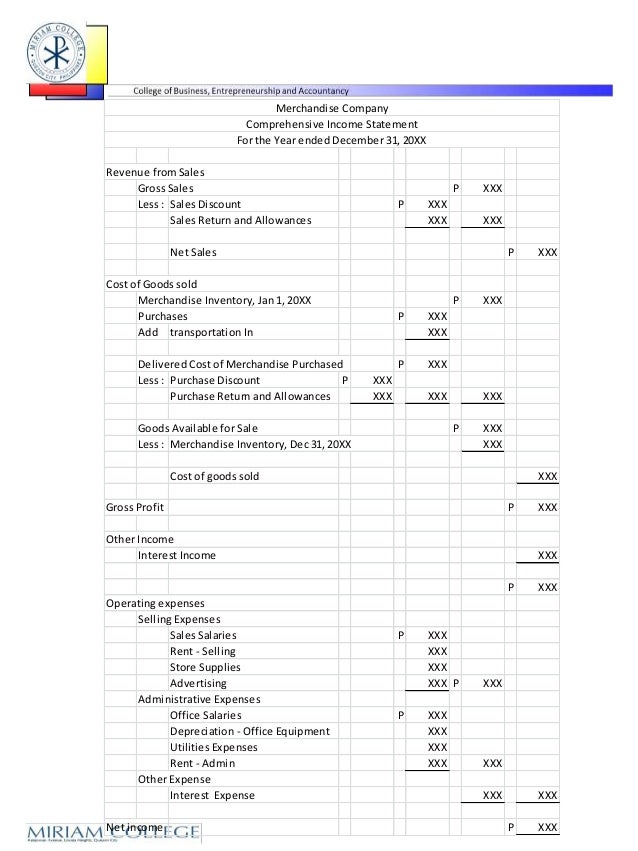

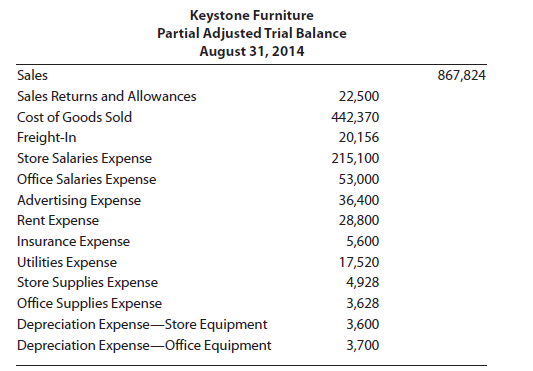

Store Supplies Expense Income Statement

They are initially recorded as asset by debiting office or store supplies account and crediting cash account at the end of the accounting period the total cost of supplies used during the period becomes an expense and an adjusting entry is made for it if this adjusting entry is not made the income.

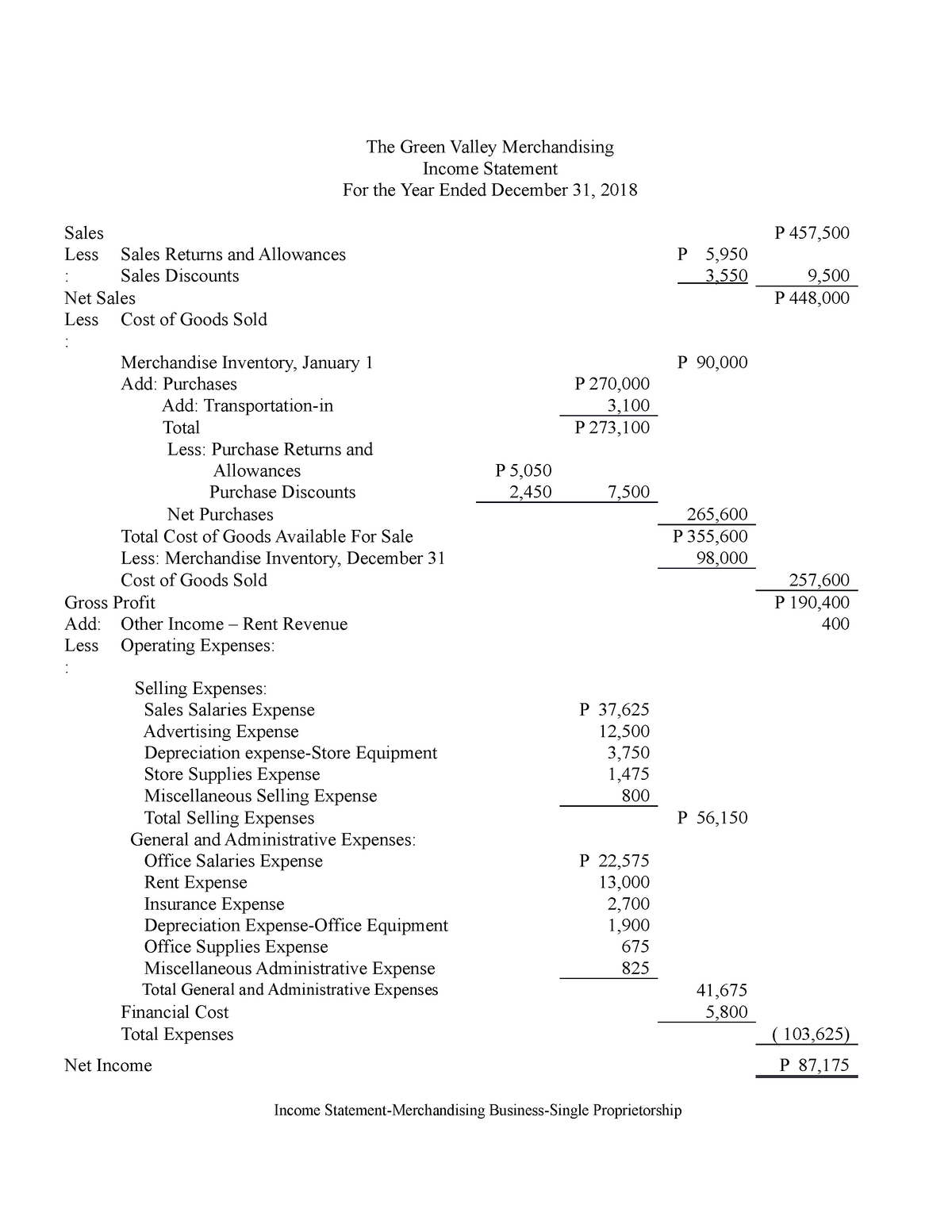

Store supplies expense income statement. Office supplies expense on income statement. A sporting goods store reports the expenses it incurs to run its primary day to day business activities as operating expenses on the income statement. At the end of the accounting period the balance in the account supplies will be adjusted to be the amount on hand and the amount of the. When supplies are purchased the amount will be debited to supplies.

You can follow the textbook pp 106 117. And how do i find it. The cost of the office supplies used up during the accounting period should be recorded in the income statement account supplies expense. If your business does not use a lot of office supplies and you don t order them in bulk the office supplies expense that you will record on your company s income statement will equal the amount of money your business spent to purchase office supplies during the months covered by your income statement.

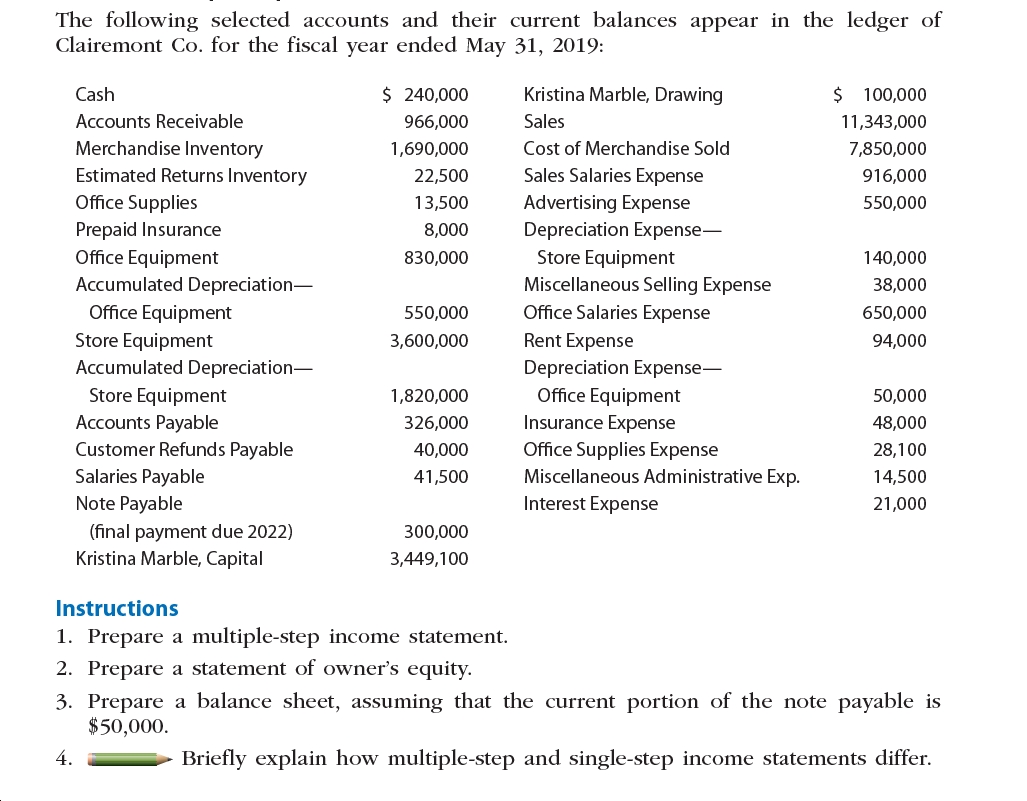

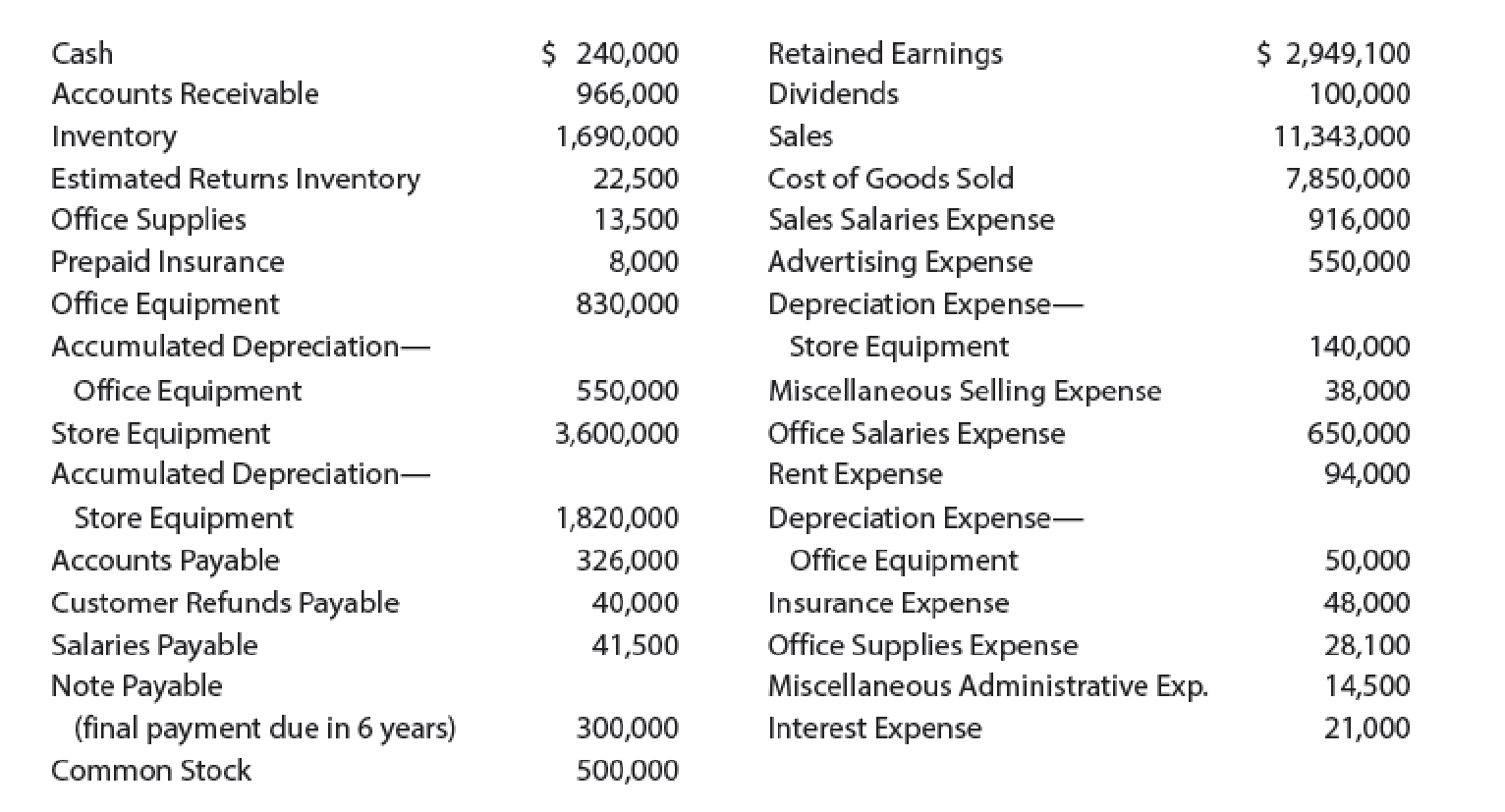

Supplies expense refers to the cost of consumables used during a reporting period. If supplies already used then it is expense and part of income statement but if supplies not used yet then it will shown in current assets portion of balance sheet. Depending on the type of business this can be one of the larger corporate expenses. Cash 240 000 accounts receivable 966 000 merchandise inventory 1 690 000 estimated returns inventory 22 500 office supplies 13 500 prepaid insurance 8 000 office equipment 830 000 accumulated depreciation.

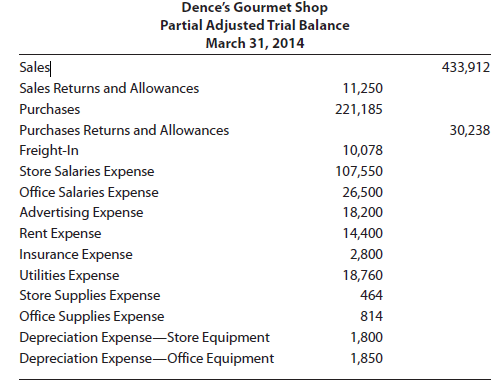

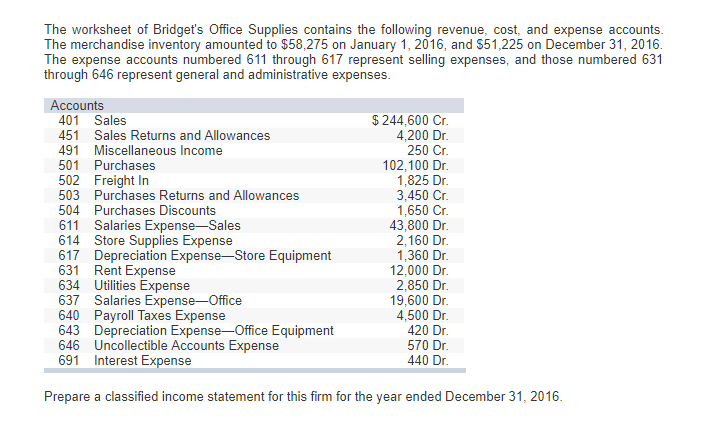

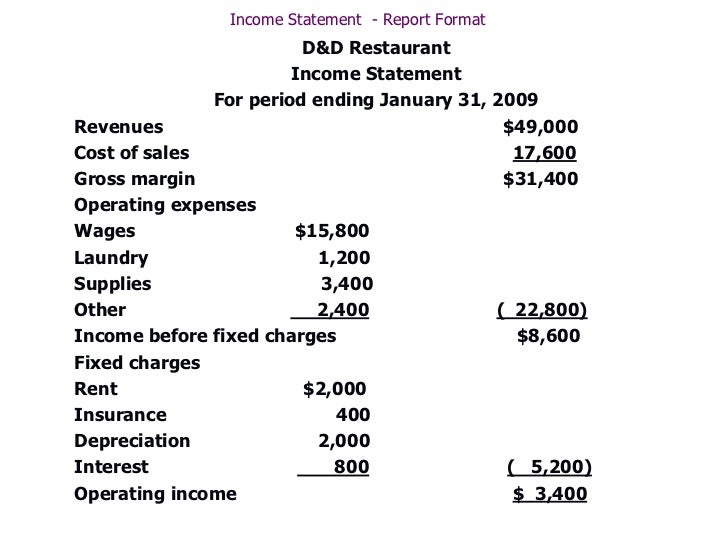

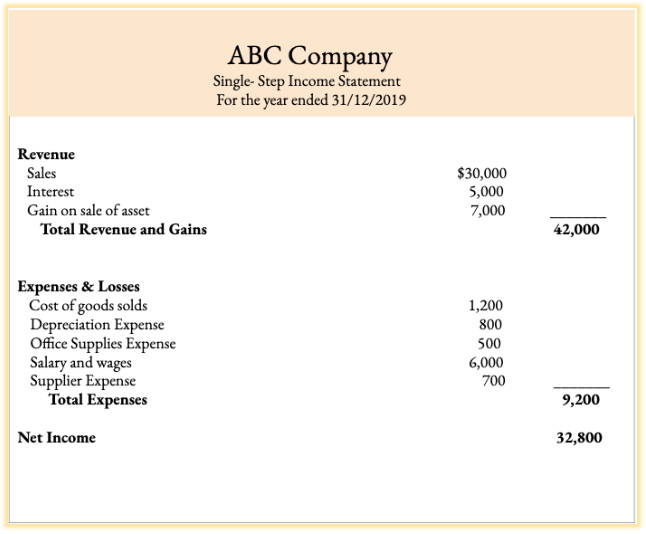

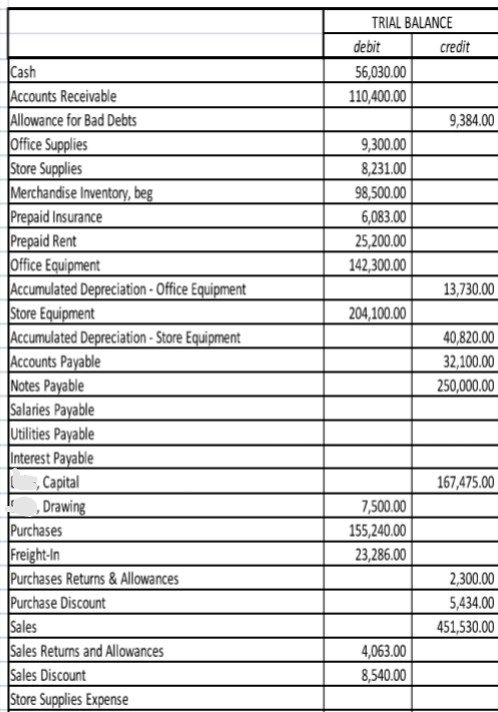

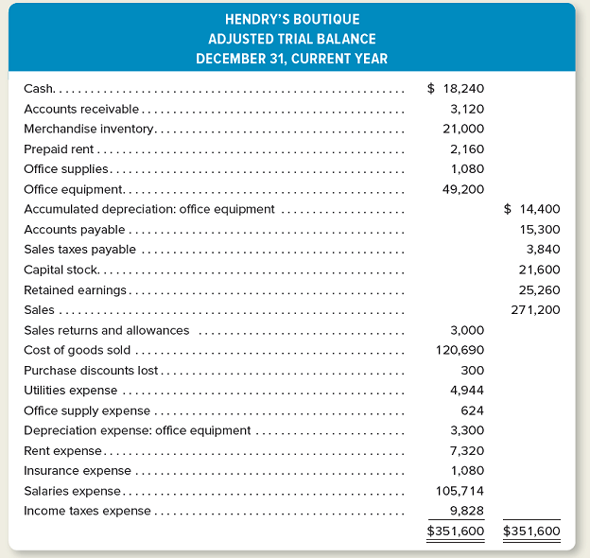

Supplies expense 3 700 cr. Multiple step income statement and balance sheet the following selected accounts and their current balances appear in the ledger of clairemont co. There are two types of supplies that may be charged to expense which are. Income statement retained earnings statement and statement of financial position 6 journalize and post the closing.

The accounting for office or store supplies is similar to prepaid or unexpired expenses. 2009 supplies inventory 11000 2009 supplies purchases 15000 physical count of inventory at end of 2009 12200 what should the 2009 income statement report for the amount of supplies expense. These supplies include mainten. For the fiscal year ended may 31.

Such expenses include commissions and wages for sales associates salaries for store managers and administrative personnel rent insurance janitorial services office supplies property. A basic multiple step income statement is set up to separate operating. Store supplies 3 700 you need to do same for the other adjustments.