The Income Statement Of A Company Shows Earnings Before Interest

Ebit earnings before interest and taxes is a company s net income before income tax expense and interest expenses are deducted ebit is used to analyze the performance of a company s core.

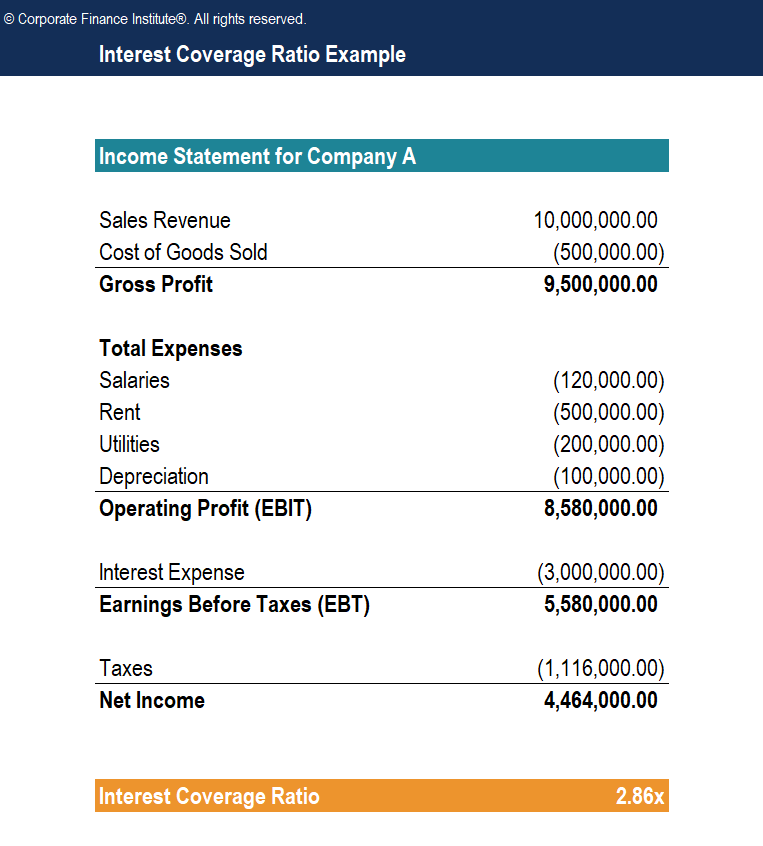

The income statement of a company shows earnings before interest. Profit before tax revenue expenses exclusive of the tax expense profit before tax 2 000 000 1 750 000 250 000. Earnings and income both refer to a company s bottom line. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting. Ebit is also sometimes referred to as operating.

Investors compare the ebit metrics of different companies because it shows them how efficient and successful the operating activities of the companies are. It s an important value for companies and investors to consider because this income statement item shows how much money the company is making and how much it has to pay in taxes. Income can be designated as gross vs. A total of 560 million in selling and operating expenses and 293 million in general and administrative expenses were subtracted from that.

This income statement shows that the company brought in a total of 4 358 billion through sales and it cost approximately 2 738 billion to achieve those sales for a gross profit of 1 619 billion. Net or by source such as interest income. Profit before taxes and earnings before interest and tax ebit ebit guide ebit stands for earnings before interest and taxes and is one of the last subtotals in the income statement before net income. Incontact reported last year earnings before interest taxes and depreciation amortization ebitda of 5 84 million.

The amount of profit left over after paying all expenses. Ebit is used to analyze the performance of a company s core. Incontact earnings before interest taxes and depreciation amortization ebitda are relatively stable at the moment as compared to the past year. Ebit earnings before interest and taxes is a company s net income before income tax expense and interest expense have been deducted.

Analyze incontact earnings before interest taxes and depreciation amortization ebitda.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-02-23bef448b8aa4c9bac46c8e15b2b9f0a.jpg)