Horizontal Analysis Of Comparative Income Statement

Colgate horizontal analysis example.

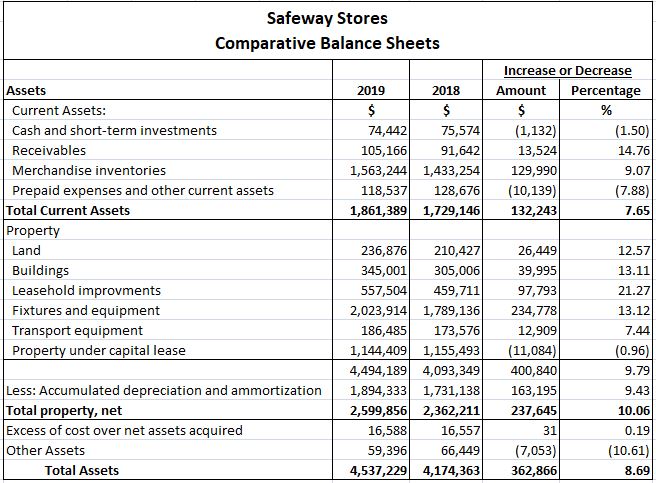

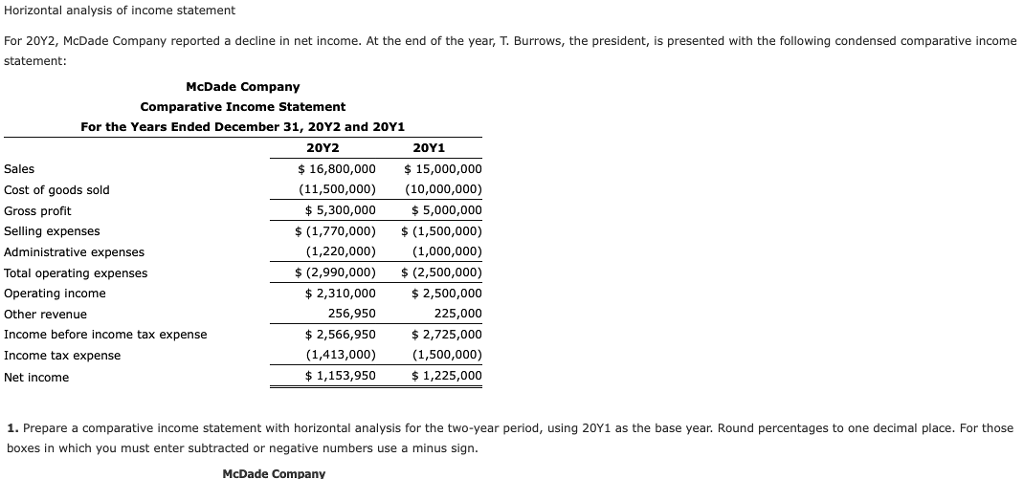

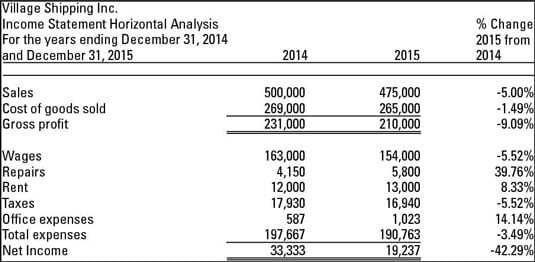

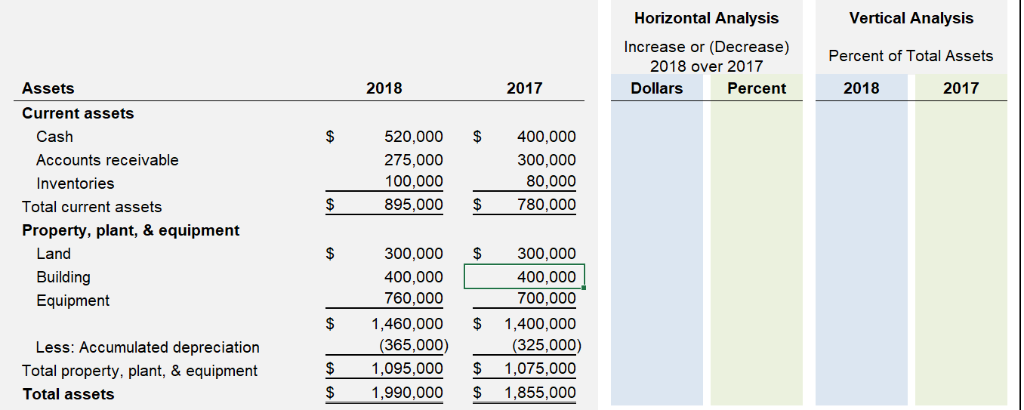

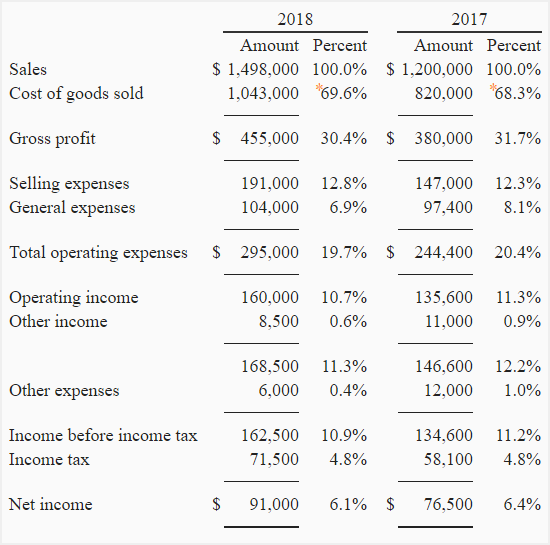

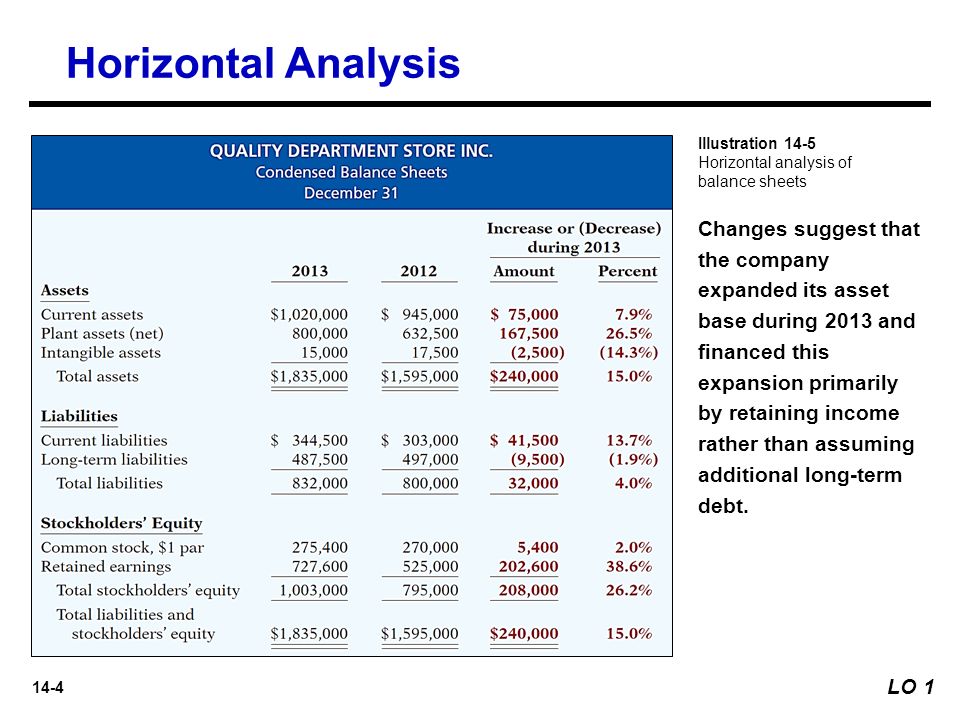

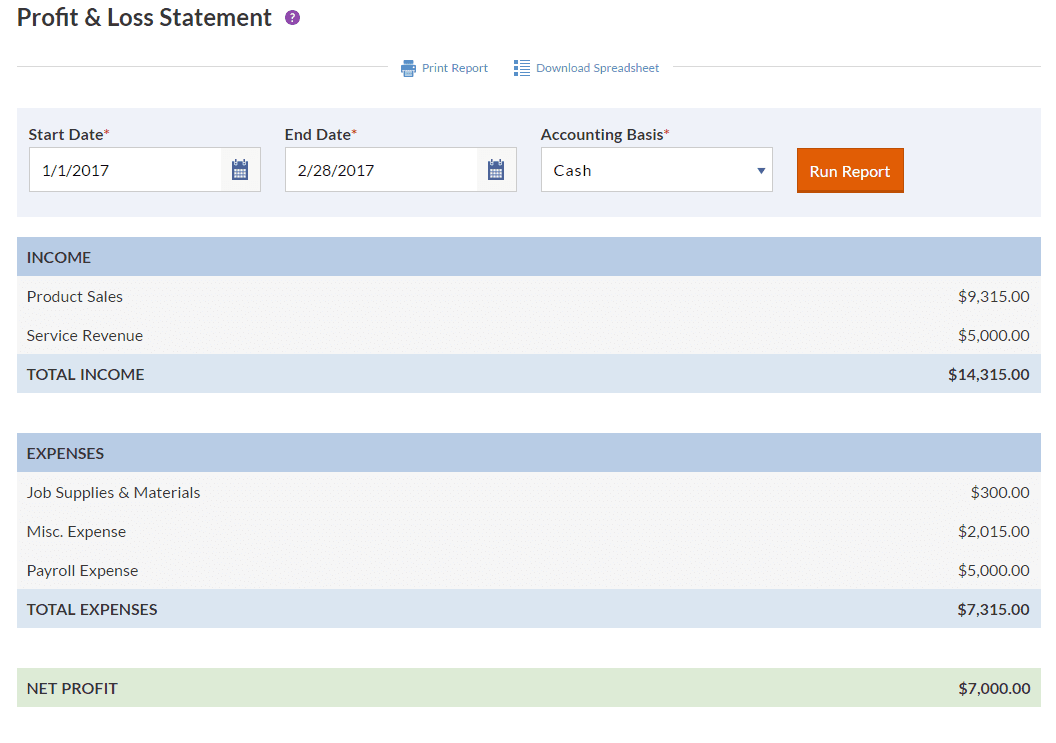

Horizontal analysis of comparative income statement. Consider the following example of comparative income statement analysis. Comparative retained earnings statement with horizontal analysis. Comparative balance sheet with horizontal analysis. If you made 45 000 in 2015 and 50 000 in 2016.

Horizontal analysis involves the computation of amount changes and percentage changes from the previous to the current year. Horizontal analysis of financial statement formula and calculation. Here we have the yoy growth rates of colgate s income statement from 2008 until 2015. Prepare a horizontal analysis of the comparative income statement of harlan designs inc.

In above analysis 2007 is the base year and 2008 is the comparison year. One of the popular techniques of comparative income statement which shows the change in amount both in absolute and percentage terms over a period of time. It helps in easy analysis of trends and as such also known as trend analysis. In the relative financial statement of the companies.

Trend analysis for income statement items using excel. The percentage analysis of increases and decreases in corresponding items in comparative financial statements is called horizontal analysis. Why did 2016 net income increase by a higher percentage than net sales. When calculating growth look at the percentage of change between accounting periods.

Horizontal analysis is the method of function statement analysis which represents the percentage income and percentage decrease. Types of comparative income statement analysis 1 horizontal analysis. Round percentage changes to one decimal place. Trend analysis for income statement items using excel.

Let us now look at the horizontal analysis of colgate. In the horizontal analysis the financial data of the companies is compared to the base of the comparative financial statement for fixing the problems within the. A horizontal or time series analysis looks at trends over time. You can see growth patterns and seasonality.

Likewise we can do the same for all the other entries in the income statement. We calculate the growth rate of each of the line items with respect to the previous year.