Income Tax Expense Is Calculated As The Result Of The Combination Of

A tax expense is a liability owing to federal state provincial and municipal governments.

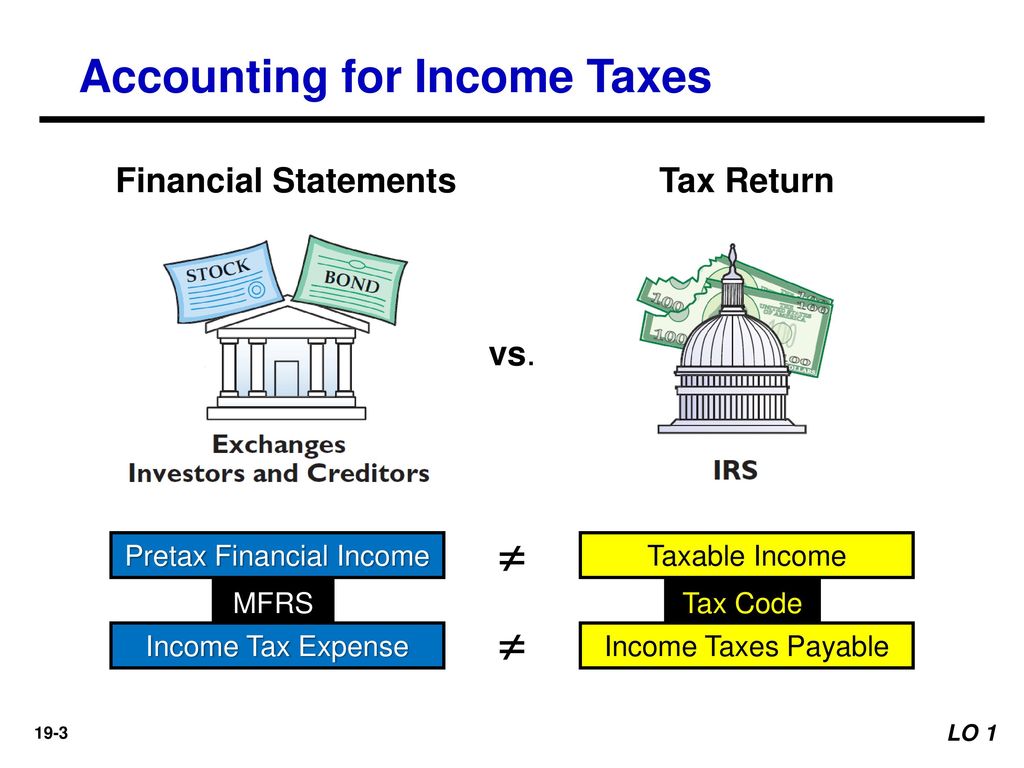

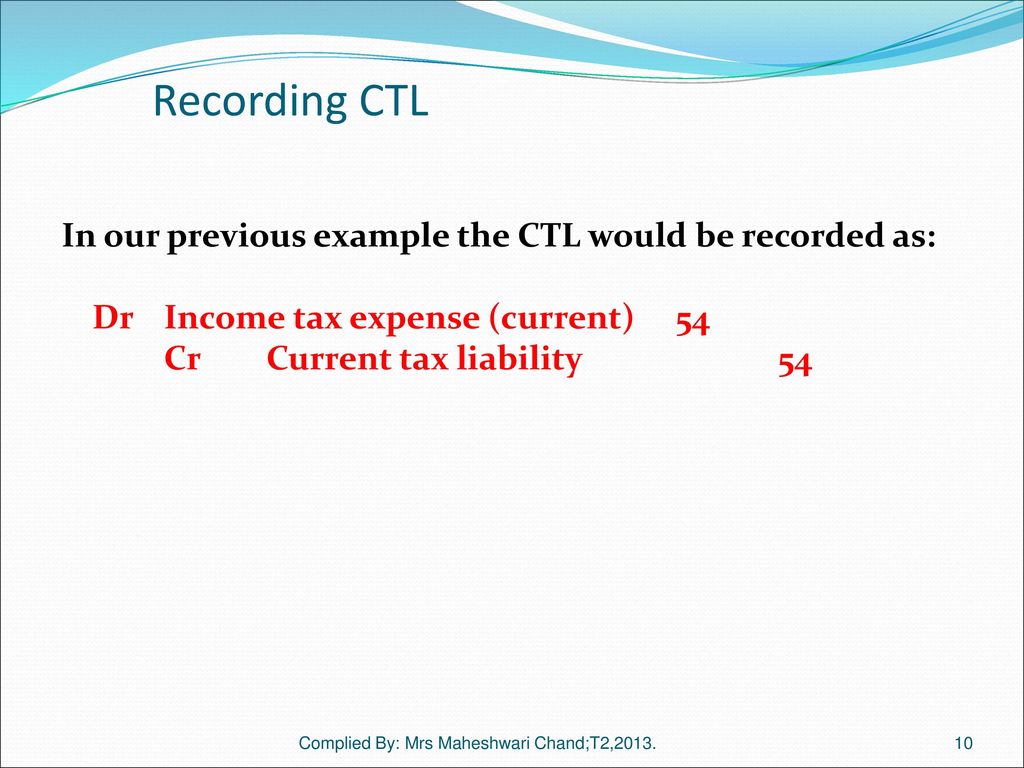

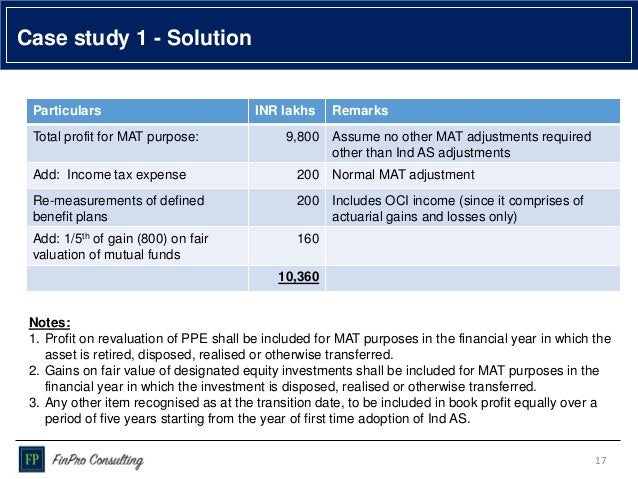

Income tax expense is calculated as the result of the combination of. Management taking a tax position that might differ from the irs position. Businesses use gaap to calculate income tax expense. Uncertainty in income tax expenses results from. Current income tax payable.

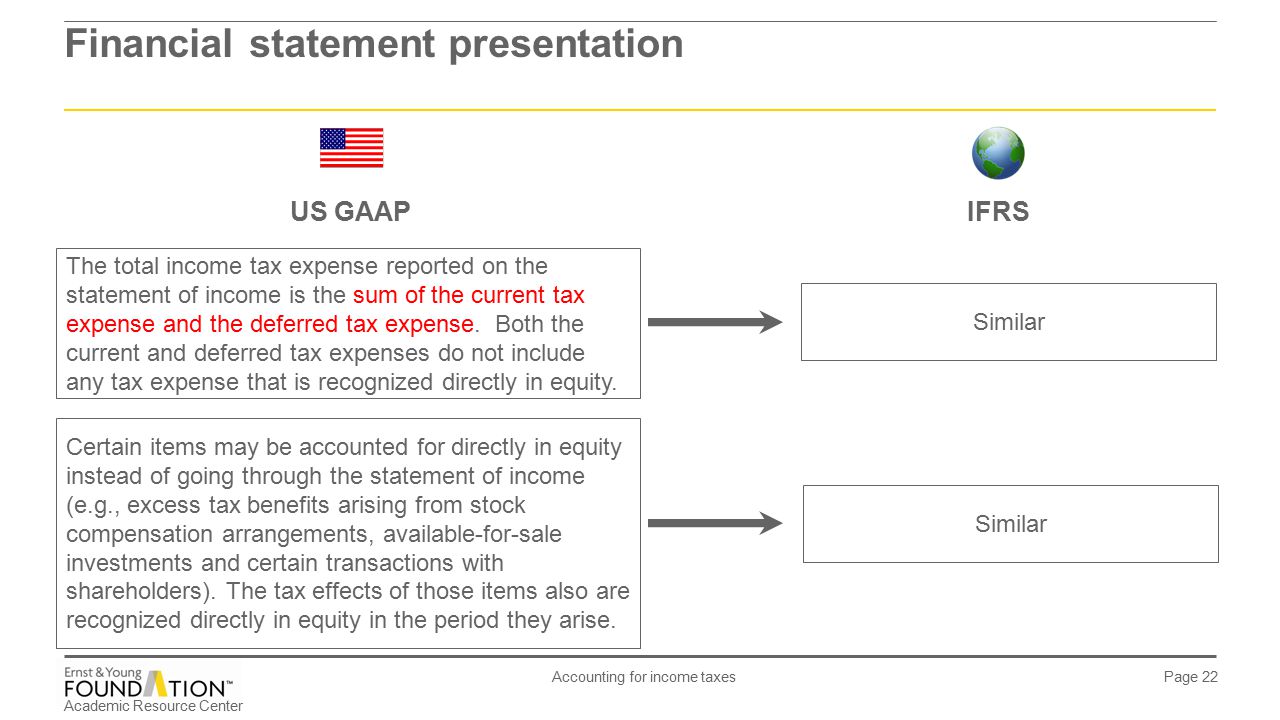

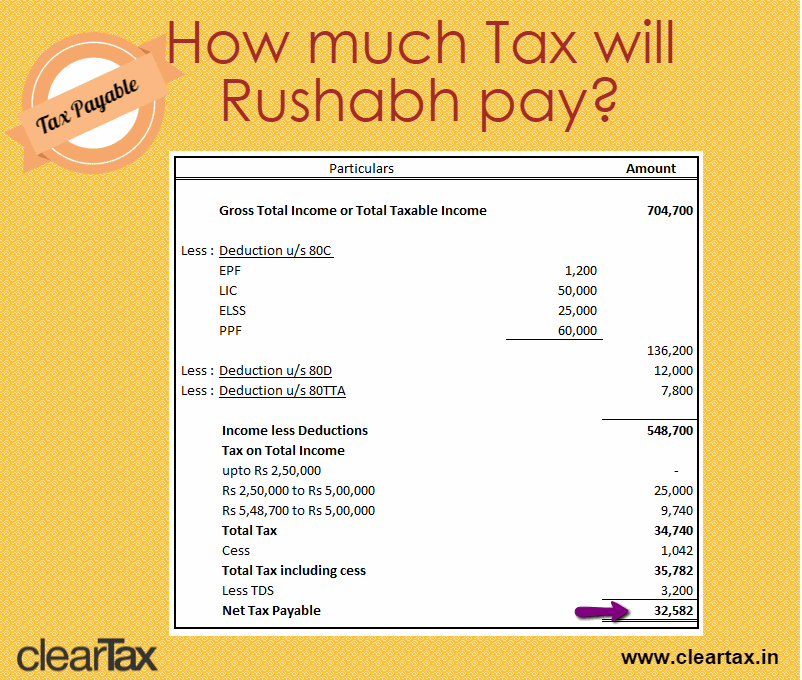

Differences between the carrying amount and tax base of assets and liabilities and. Guidance for income tax accounting is contained in ias 2 in case of ifrs and asc 740 in case of us gaap. However if the current tax arises from a transaction or event recognized outside profit or loss either in other comprehensive income or directly in equity then current income tax shall be recognized in the same way. Select the cell you will place the calculated result at enter the formula vlookup c1 a5 d12 4 true c1 vlookup c1 a5 d12 1 true vlookup c1 a5 d12 3 true into it and press the enter key.

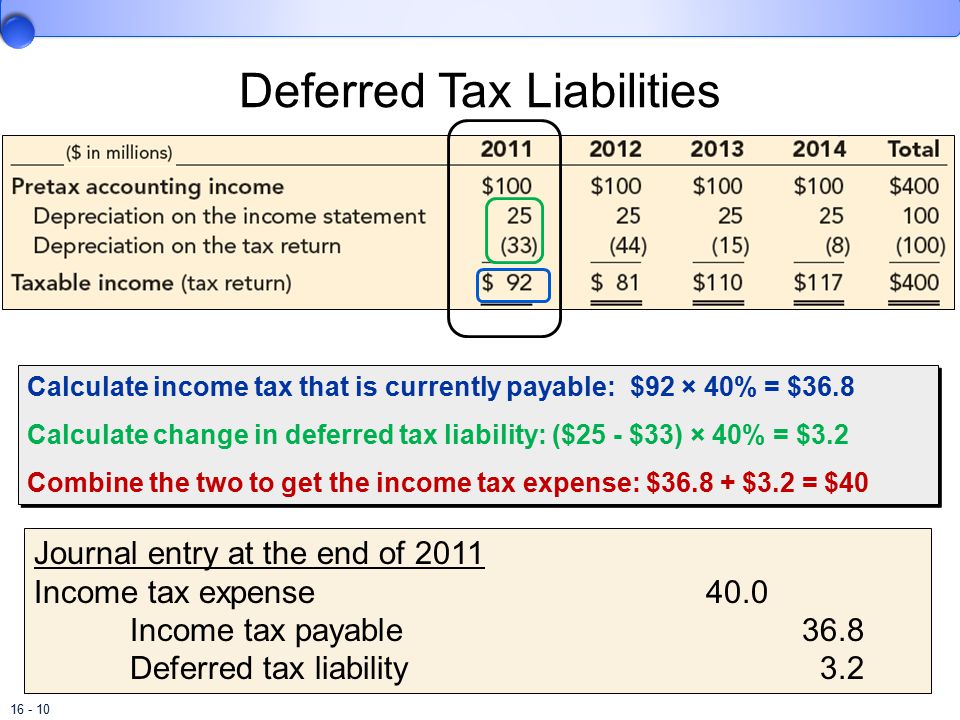

Income tax expense is calculated as the result of the combination of. Expense is calculated as the result of the combination of income tax payable and any changes in deferred tax assets and liabilities. This basic principle is to recognize income tax expense in the accounting period in which the relevant income and expense items that caused the income tax are recognized. Income tax expense is the amount of expense that a business recognizes in an accounting period for the government tax related to its taxable profit the amount of income tax expense recognized is unlikely to exactly match the standard income tax percentage that is applied to business income since there are a number of differences between the reportable amount of income under the gaap or ifrs.

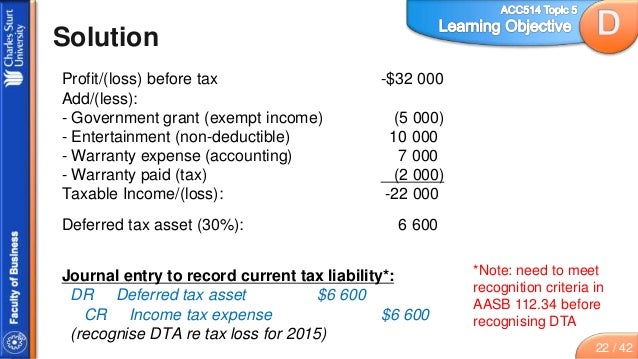

Tax expenses are calculated by multiplying the appropriate tax rate of an individual or. Calculate the income tax that is payable currently 2. Frequently you can get the tax table with cumulative tax for each tax bracket. Income tax payable income tax expense or benefit change in deferred tax asset of liability.

In this condition you can apply the vlookup function to calculate the income tax for a certain income in excel. Current income tax expense shall be recognized directly to profit or loss in most cases.

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)