Income Withholding For Spousal Support Minnesota

A copy of those sections is available from any district court clerk.

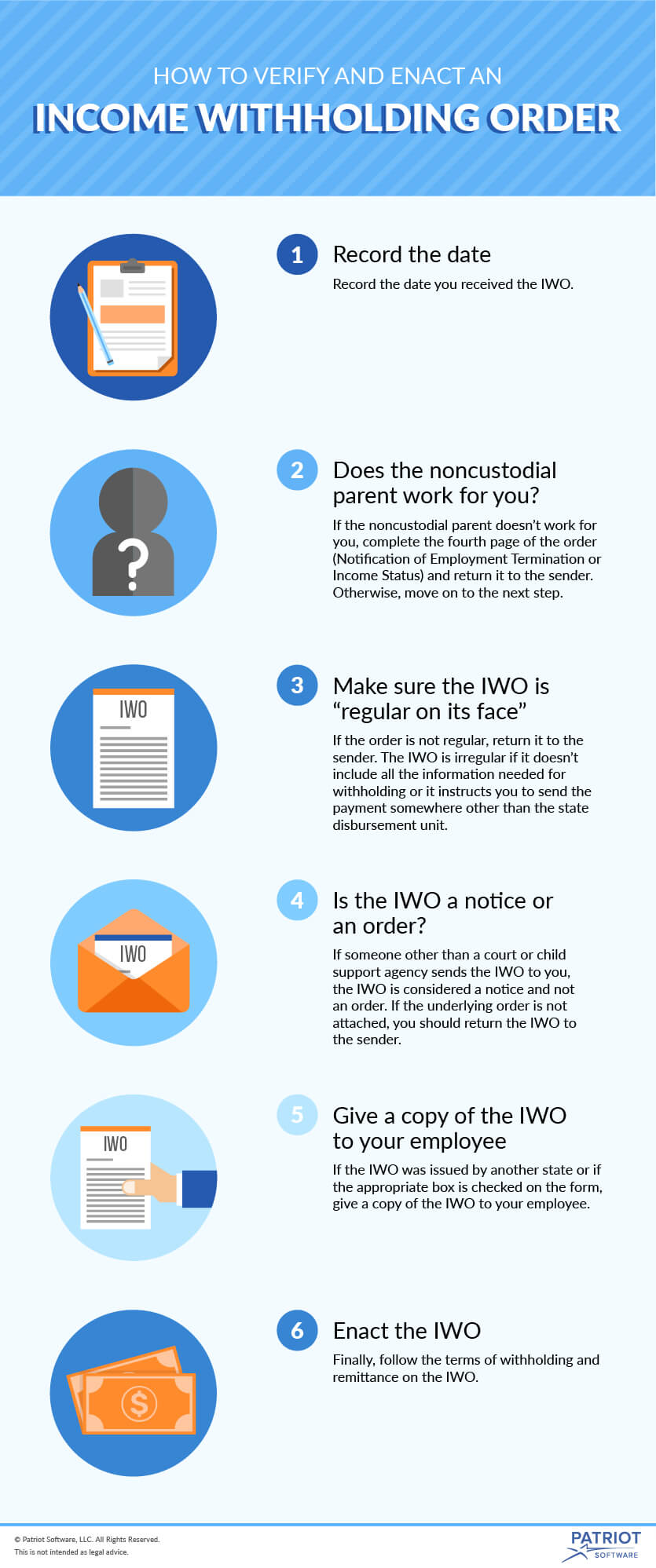

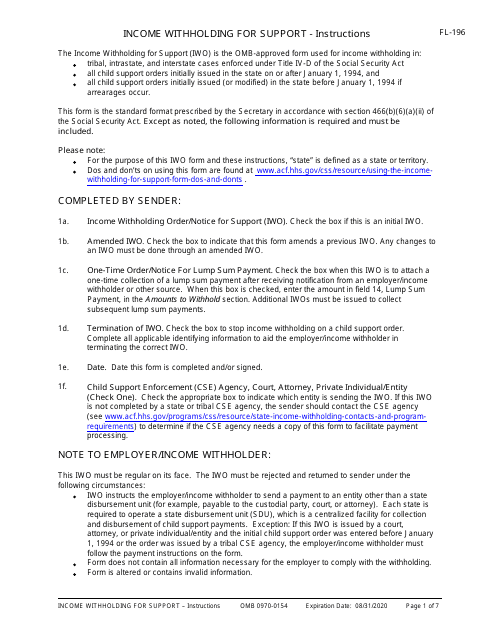

Income withholding for spousal support minnesota. Services how income withholding only services work. An amount of money paid as a single. Child support and or spousal maintenance may be withheld from income with or without notice to the person obligated to pay when the conditions of minnesota statutes section 518a 53 have been met. Certified copies should be mailed by certified mail to the employer with an affidavit of proof of service.

The total income of both parties multiplied by 40 minus the obligor spouse s income. Calculating spousal maintenance in minnesota. Providing health care coverage. Have at least one parent living away from the home.

20 of the obligee s income minus 30 of the obligor s income. Payment instead of as installment payments. A if income withholding is ineffective due to the obligor s method of obtaining income the court shall order the obligor to identify a child support deposit account owned solely by the obligor or to establish an account in a financial institution located in this state for the purpose of depositing court ordered child support payments. Current basic support child care support medical support or spousal support obligation and arrears from an obligor s wages or other sources of income.

Have a court order for child support or spousal maintenance. If you choose income withholding only services now you can apply for full child support services at any time. 2 income withholding the deduction of a current basic support child care support medical support or spousal maintenance obligation and arrears from an obligor s wages or other sources of income. Income withholding of support payments most new or modified child support orders require employers and payors of funds to automatically withhold basic support medical support and child care support obligations from a parent s paycheck or other sources of income.

The support and. Each parent s gross monthly income from all sources. Even then technically most illinois counties are using forms that do not comply with the national requirements but most employers will still comply. The income withholding order needs to be accompanied by a uniform order for support.

Wage and income deduction of support and maintenance. In minnesota calculating spousal maintenance is not an exact science. Spousal maintenance and child support spousal maintenance in minnesota. Income withholding only services are available to parents who.