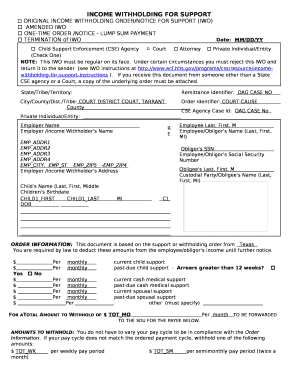

Income Withholding For Support Texas

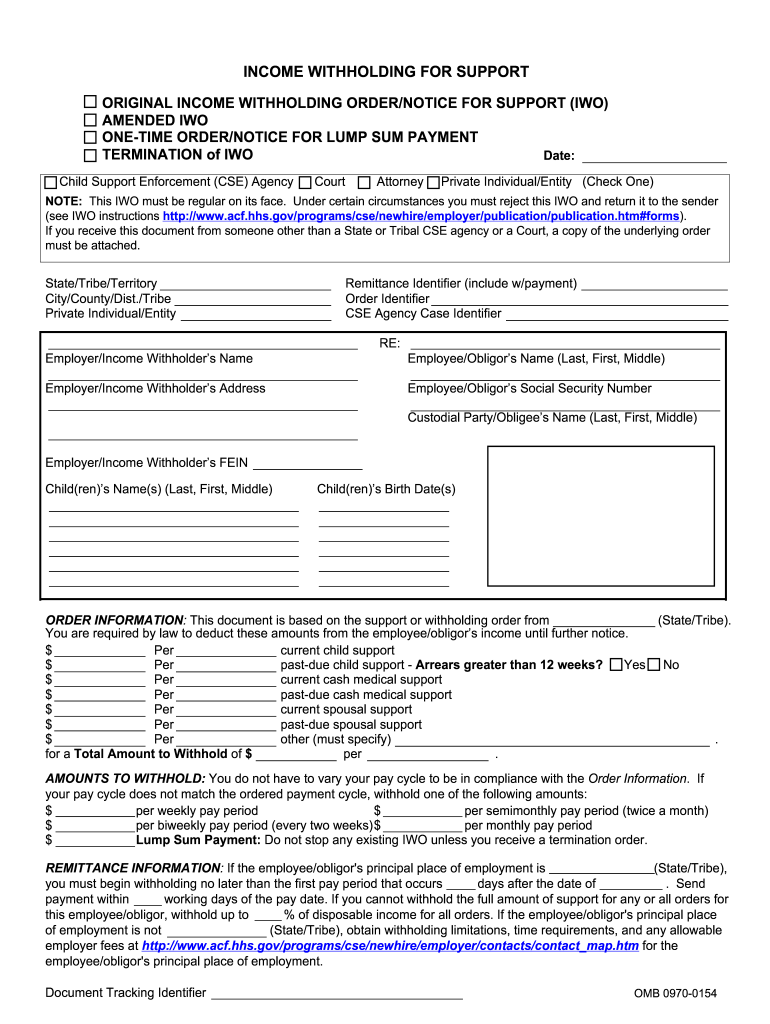

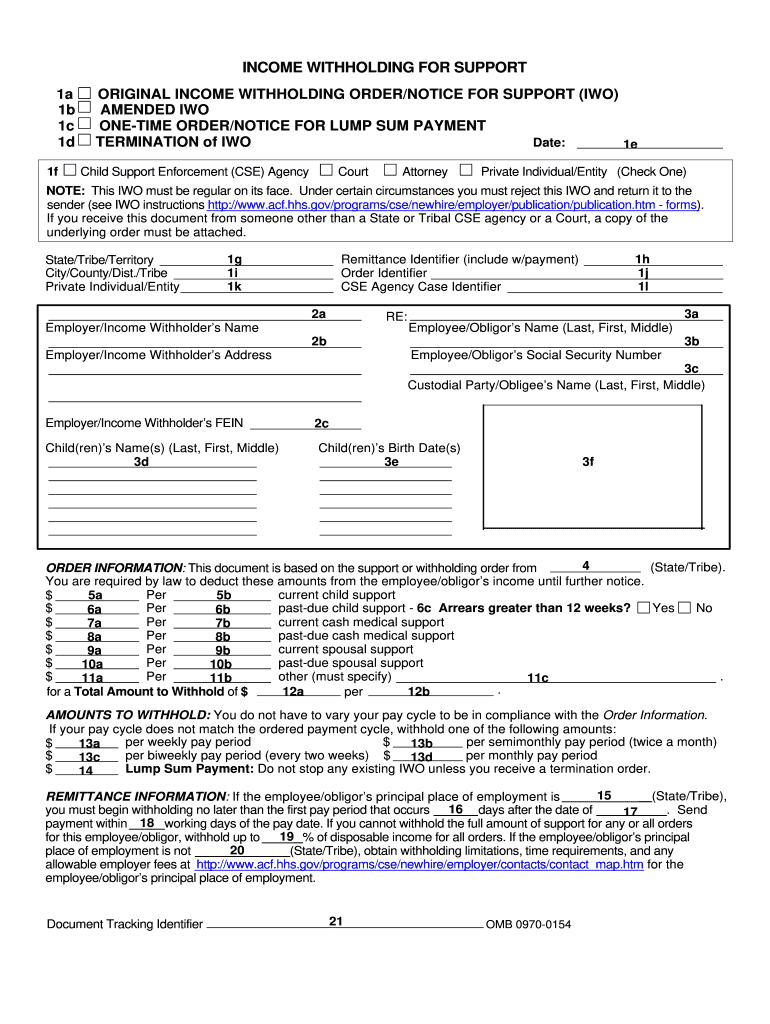

Income withholding order notice for support iwo f057 amended iwo f058 one time order notice for lump sum payment f062 termination of iwo f059 date.

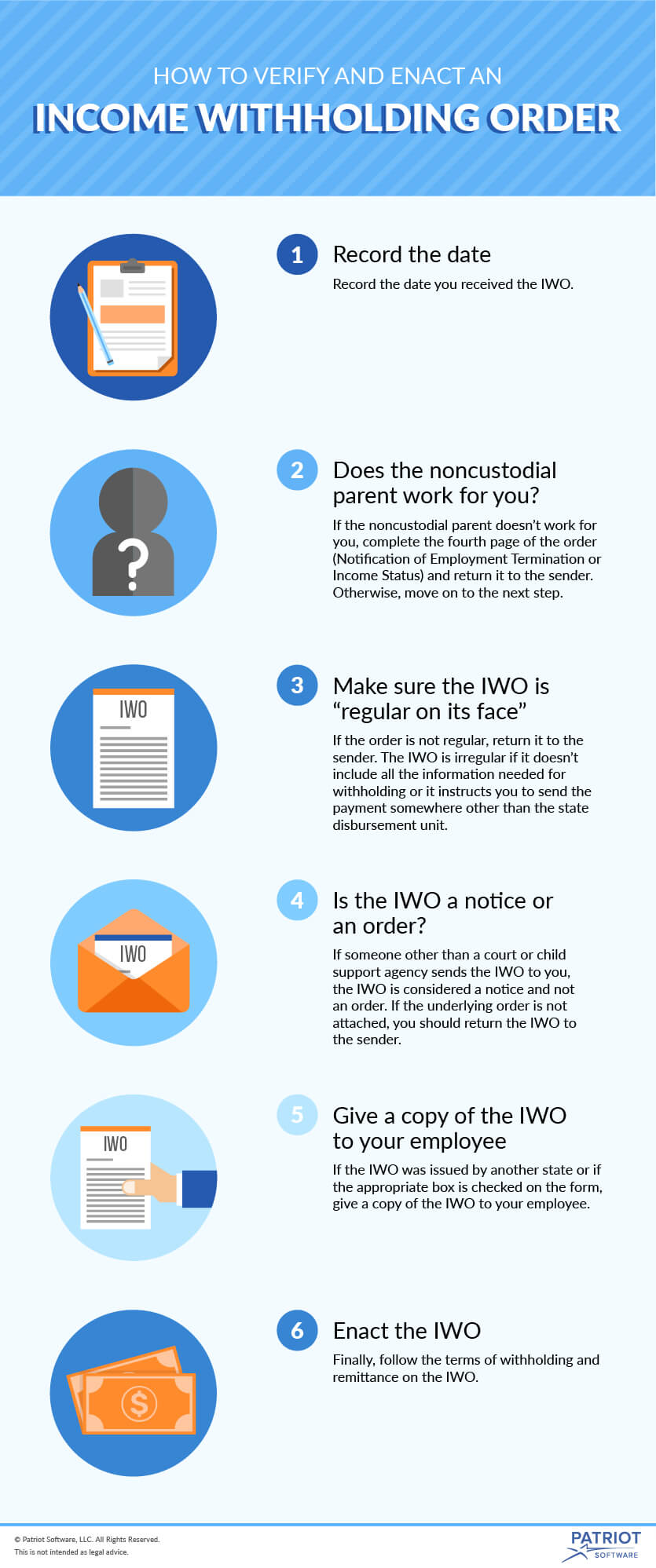

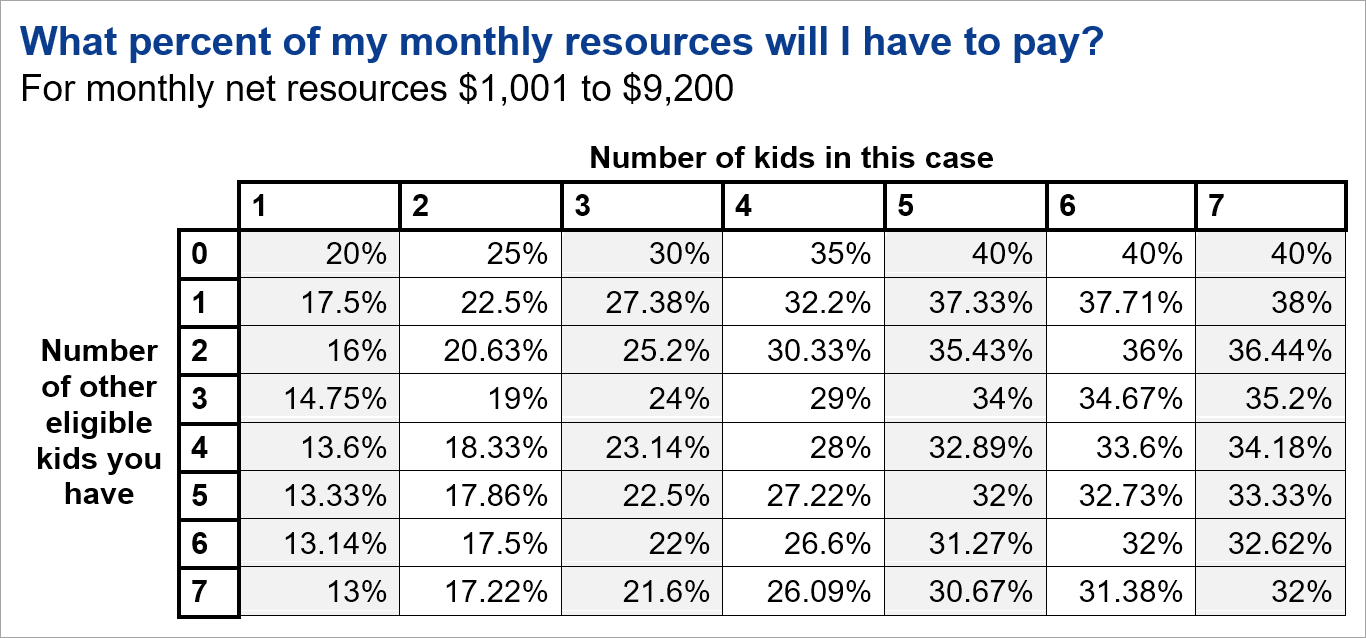

Income withholding for support texas. Withholding for support has priority over any other legal process under state law against the same income 42 usc 666 b 7. Income withholding examples of multiple orders for an employee. Upon receipt of an order notice to withhold income for child support or notice of an order to withhold income for child support an employer is considered to have been officially notified to begin income withholding from the employee named and to remit the amount withheld. While income withholding is often linked to failure to pay child support it can also arise with spousal support.

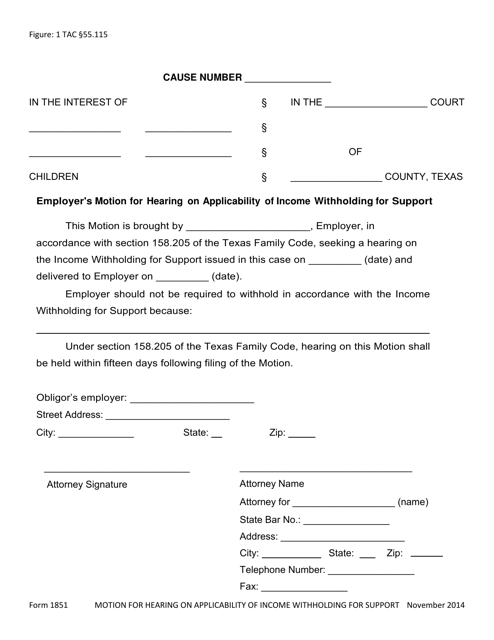

The judicial writ of income withholding issued by the clerk must direct that the employer or a subsequent employer withhold from the obligor s disposable income for current child support including medical support and dental support and child support arrearages an amount that is consistent with the provisions of this chapter regarding orders. 1st order 100 00 per month for current support and 50 00 per month for arrears. The children will be paid for first next will be the spousal support then there will be support arrears and finally spousal support arrears. F002 state tribe territory texas remittance id include w payment.

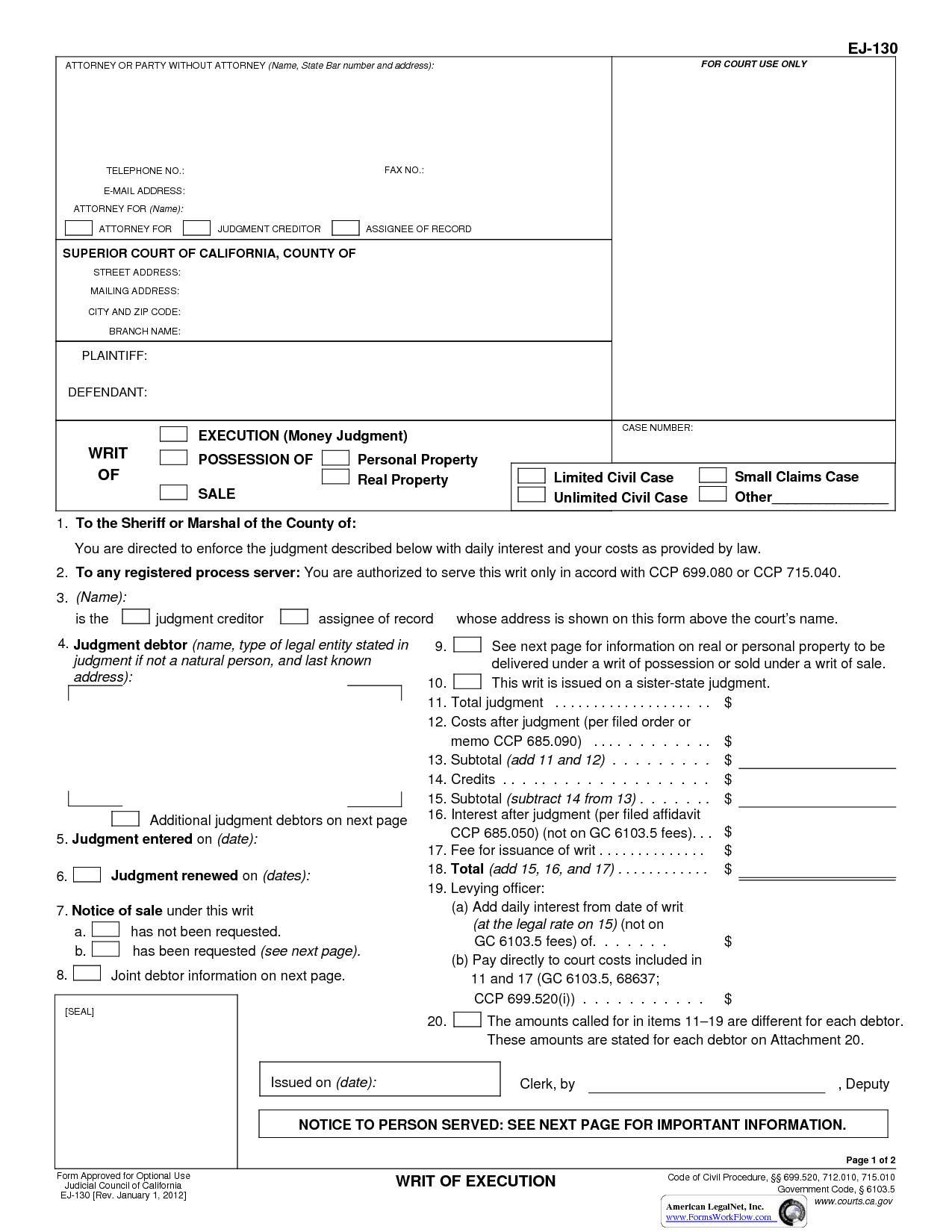

An iwo is always based on a separate order to the employee to pay support usually as part of a divorce paternity case or suit affecting the parent child. Employer authorization for third party reporting oag form 1840 revocation for third party reporting oag form 1841 order notice to withhold income for child support example form 3n051 lump sum notification. Income withholding for support. Income withholding for support iwo june 2018 omb 0970 0154 expiration date.

If a federal tax levy is in effect please notify the sender. Below are examples of how to handle multiple orders for an employee. The paying parent the obligor will have payments deducted and paid through the attorney general or a domestic relations office. Below is a list of forms that may be useful when dealing with income withholding.

The income withholding order is often a good deal. The withholding of funds goes in a certain order if there are children. Along with the support comes an income withholding order iwo to garnish child support from the paying parent s paycheck. An employer receives the following child support orders for an employee.

08 31 2020 income withholding for support. When remitting payments to an sdu or tribal cse agency you may combine withheld amounts from more than one employee obligor s income in a single payment.