How Would Each Transaction Impact The Income Statement And Balance Sheet Of Your Company

To keep learning more please check out these relevant cfi resources.

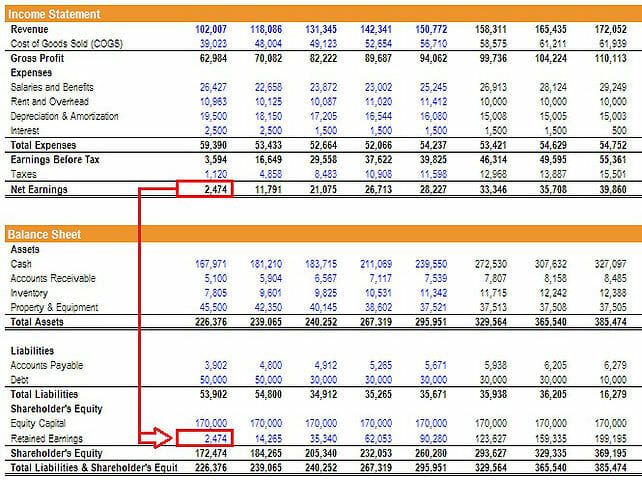

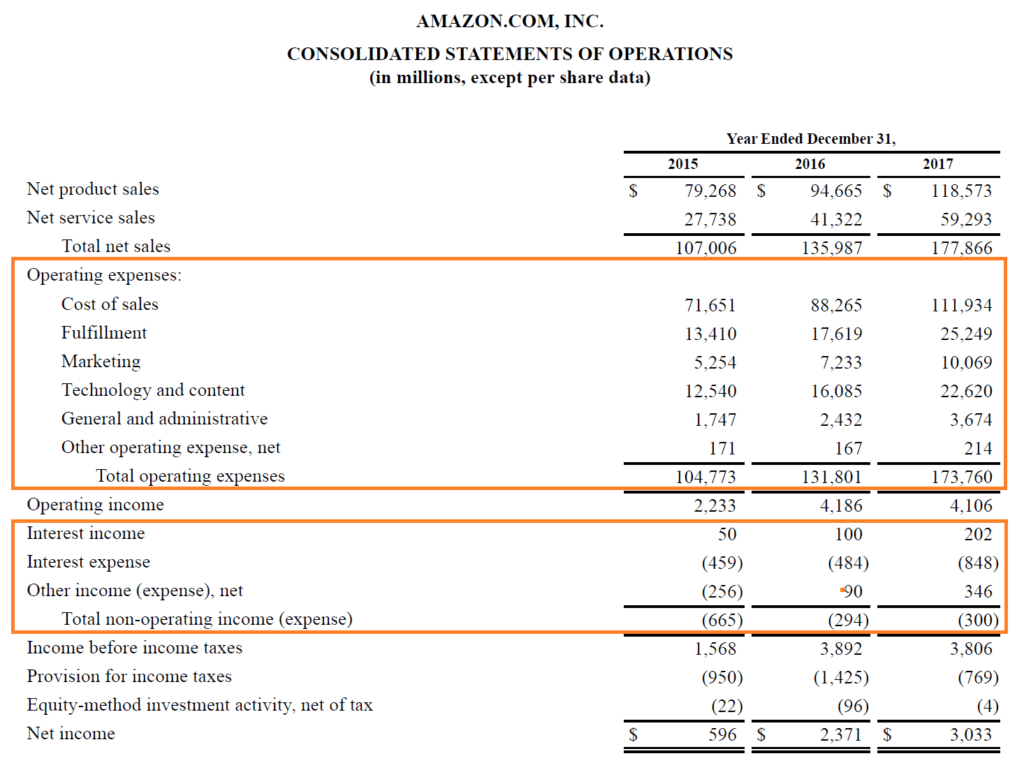

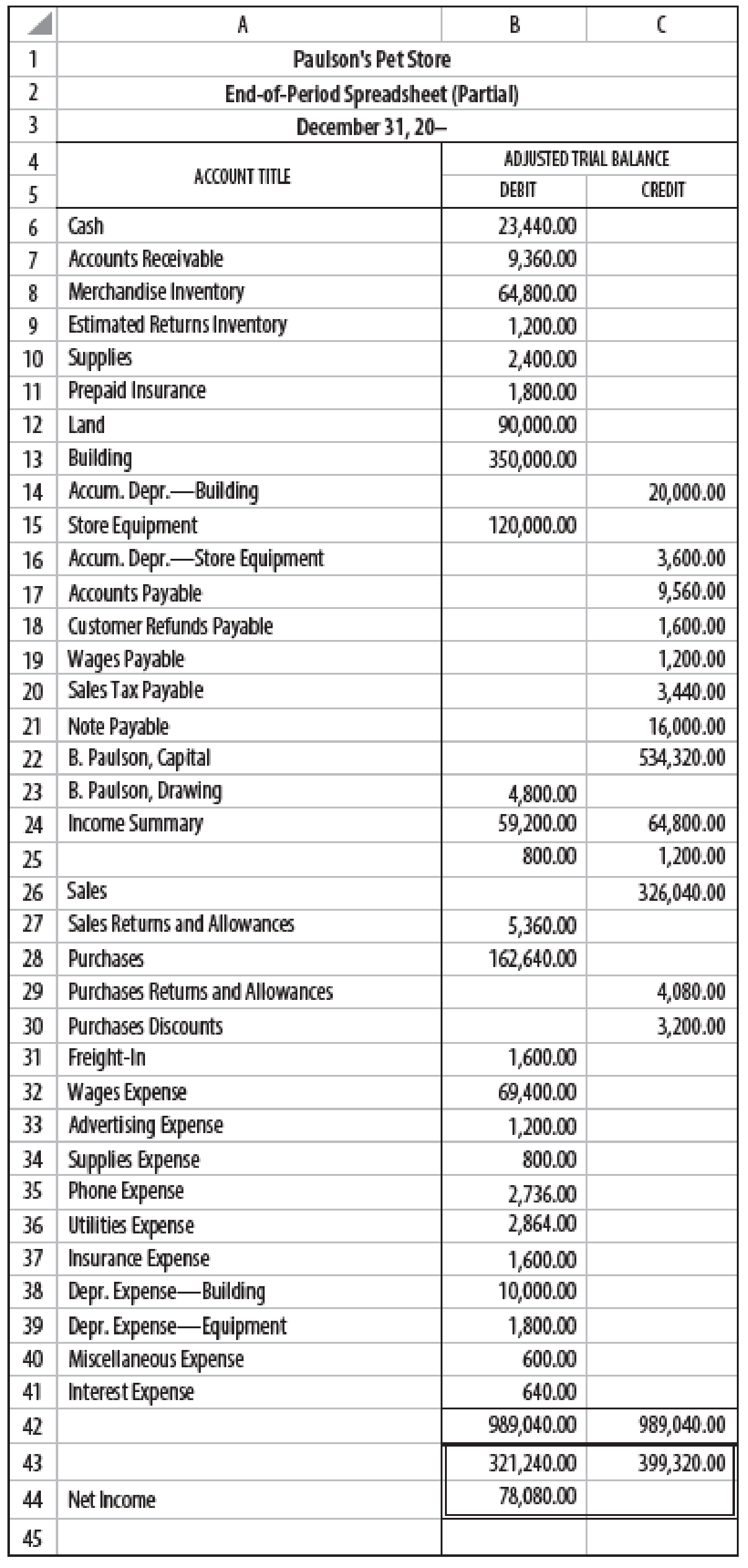

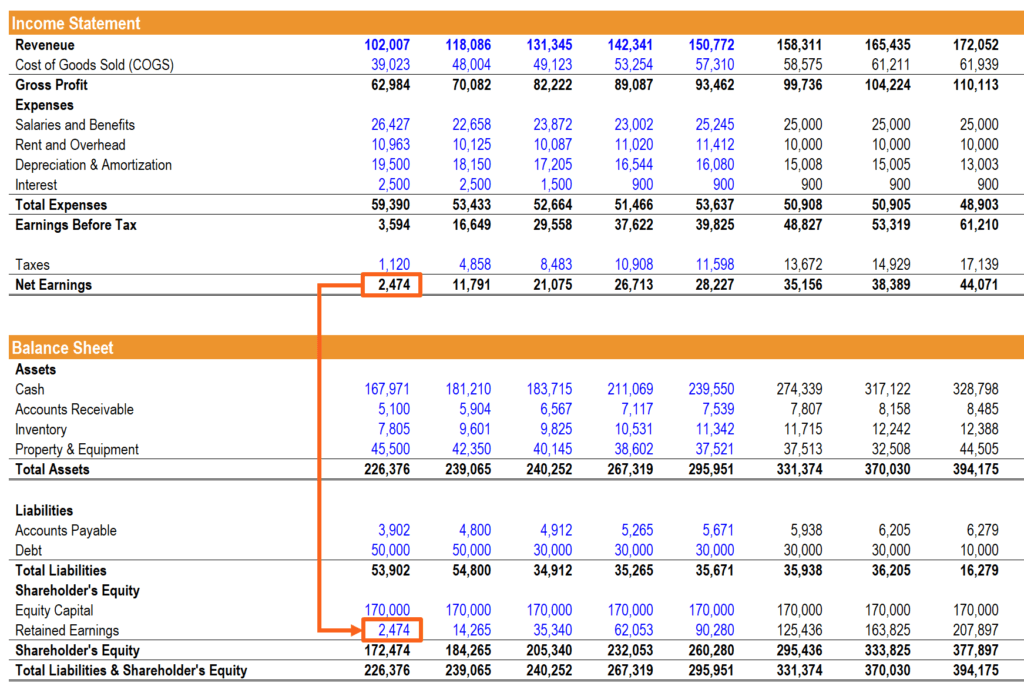

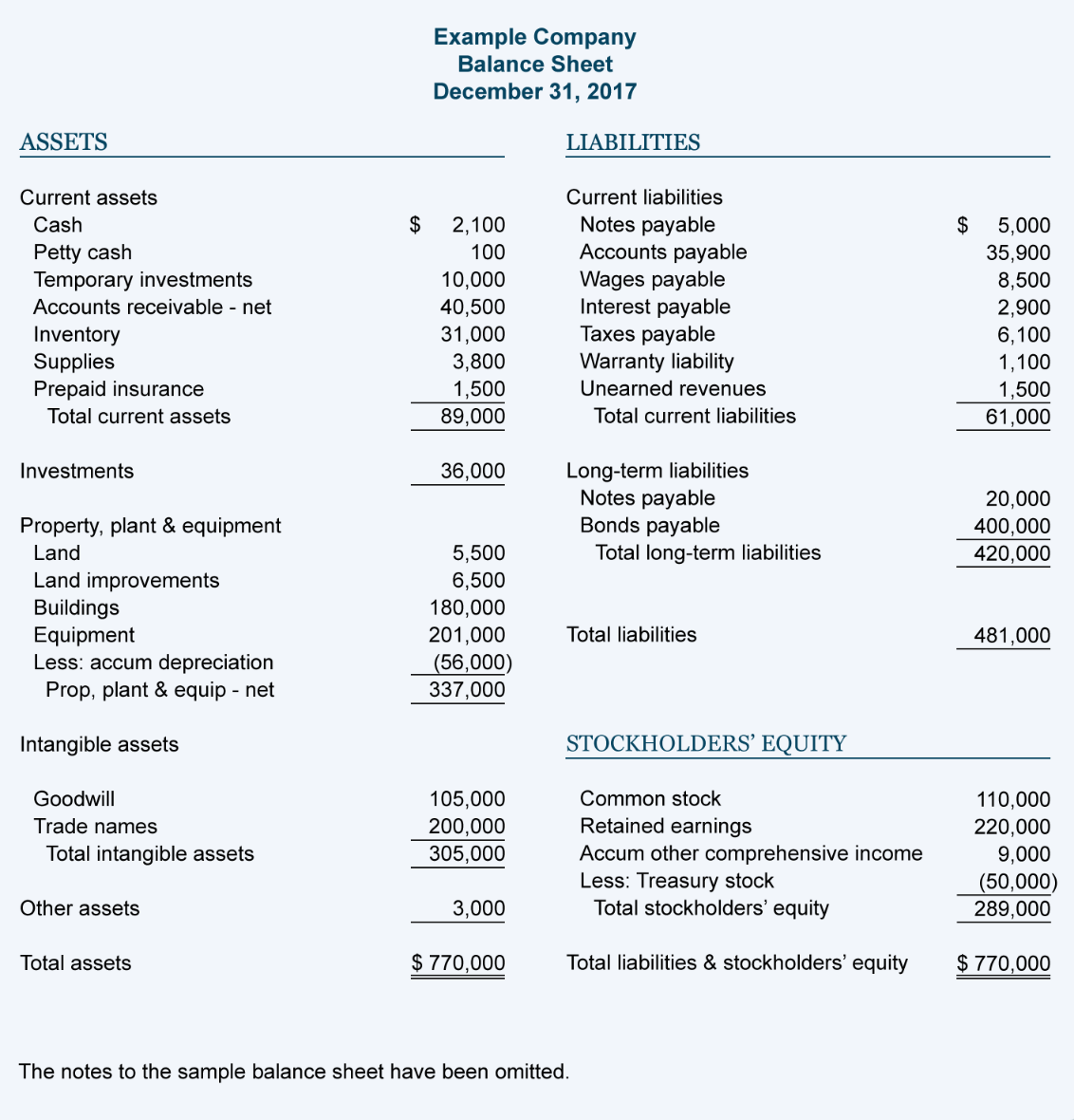

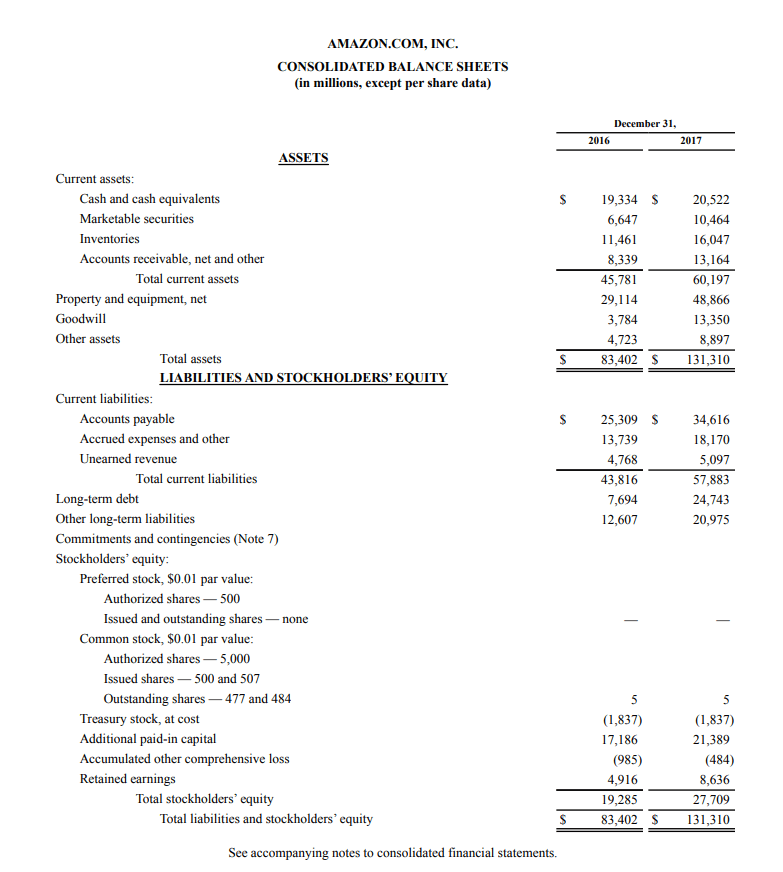

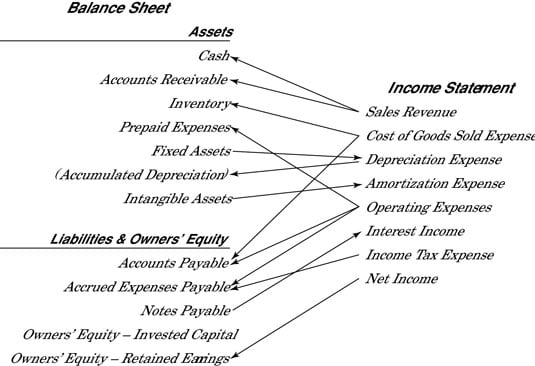

How would each transaction impact the income statement and balance sheet of your company. Here s a quick summary explaining the lines of connection in the figure starting from the top and working down to the bottom. Sample transactions debits and credits our six transactions shown below will be the input for our income statement and balance sheet. The following is a. These statements are the balance sheet income statement and statement of cash flows.

The income that an entity earns over a period of time is. Making sales and incurring expenses for making sales requires a business to maintain a working cash balance. The income statement and balance sheet of a company are linked through the net income for a period and the subsequent increase or decrease in equity that results. Green as at 31 march 2015 in both horizontal and vertical style.

Will every transaction affect an income statement account and a balance sheet account. Connections between income statement and balance sheet accounts. An accountant is responsible for capturing business transactions and determining the financial effect of those transactions on a company s balance sheet. Some transactions affect only balance sheet accounts for example when a company pays a supplier for goods previously purchased with terms of net 30 days the payment will be recorded as a debit to the liability account accounts payable and as a credit to the asset account cash.

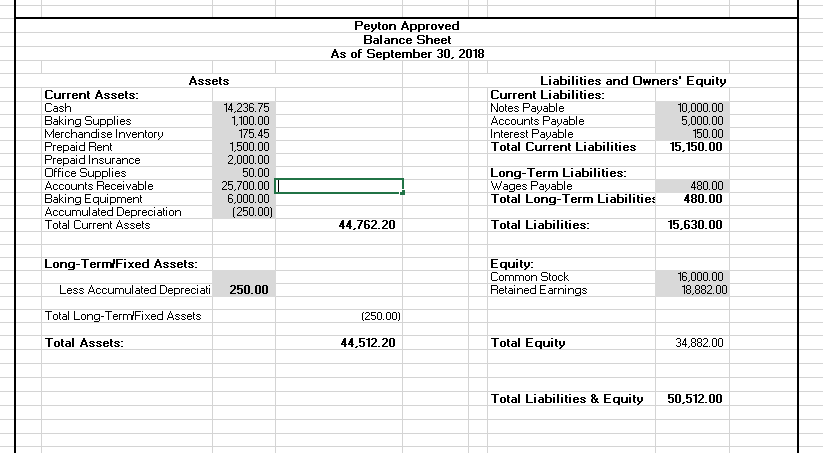

When a business incurs an expense this reduces the amount of profit reported on the income statement however the incurrence of an expense also impacts the balance sheet which is where the ending balances of all classes of assets liabilities and equity are reported. Preparation of balance sheet horizontal and vertical style. You can see that each debit has a matching credit. Practice questions use the following information to answer the questions.

We invested 3 000 in the business so our checking account cash receives a debit and we credit an equity account called paid in capital. The transactions can affect income statements and balance sheets because each transaction involve two corresponding entry debit credit which need to be balanced first before entering it to the income statement and balance sheet. Prepare balance sheet for f. Invested in the business.

The cash flow statement shows how well a company manages cash to fund operations and any expansion efforts. Using the following balance sheet see if you can calculate the impact of different transactions on a fictitious power company. Free cash flow cash flow cash flow cf is the increase or decrease in the amount of money a business institution or individual has.

/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)